Bertram: The Small Texas City Outpacing the State

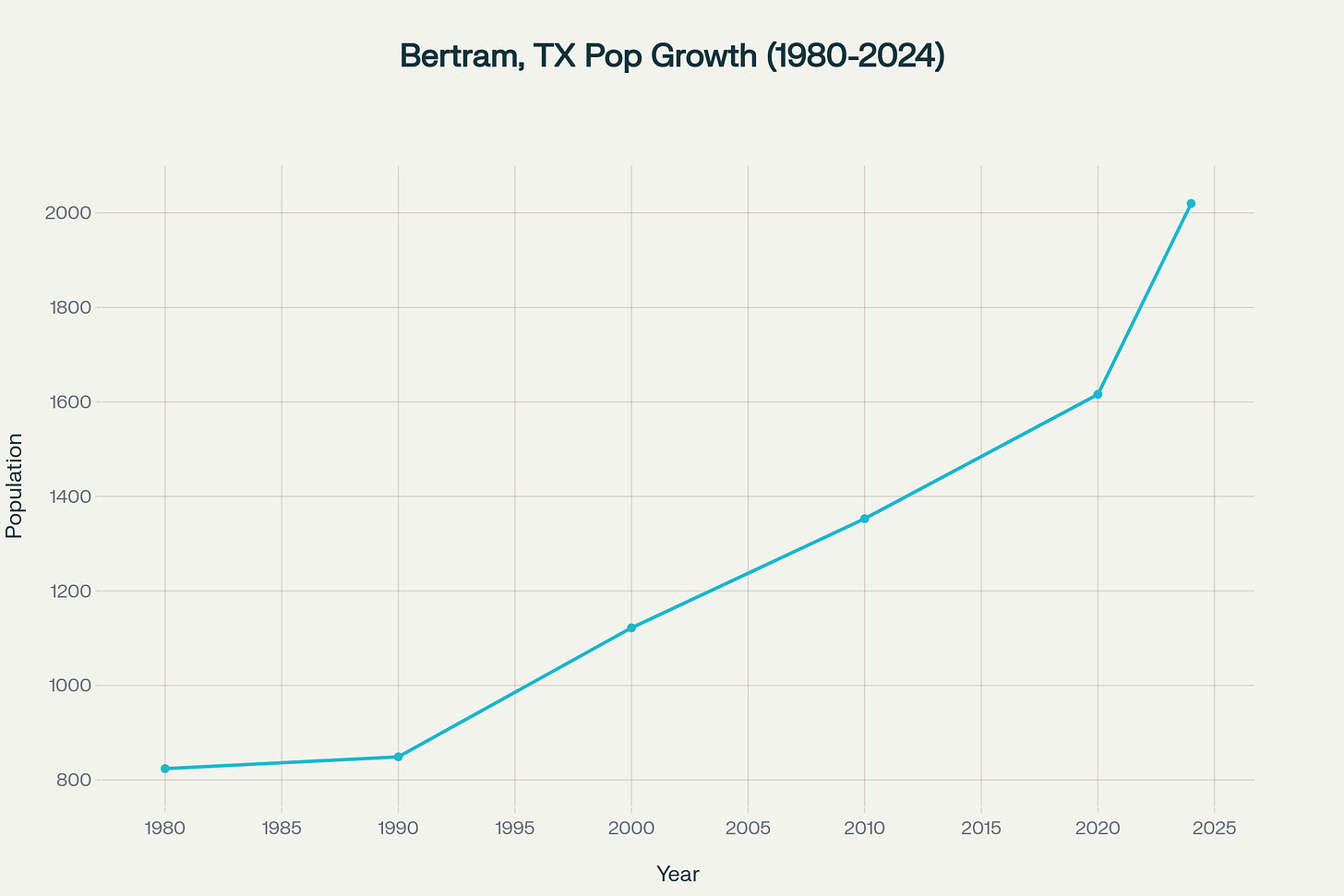

42.5% growth since 2020, millions in untapped spending, and a market still wide open.

Issue: 04

Street BLUF: Testing a new video summary AI. I didn’t edit this video, curious if adding something like this would bring value to each profile. Reply to this email or drop a comment if you’re online.

Sponsor: Bell Chime Capital - Selling Your Texas Business? Skip the lengthy sales process. Local buyers who understand your market and value what you've built. Get your free business valuation today → Visit BellchimeCapital.com

Bertram is a clear example of Austin’s growth spillover turning rural towns into suburban service hubs.

On State Highway 29 in eastern Burnet County, this former railroad stop of 2,020 residents has posted a 42.5% population jump since 2020. With major housing projects underway, the city is managing the kind of steady growth that rewards businesses and investors who track the numbers and move early.

That growth is backed by disciplined fiscal management, a competitive tax rate, and a strong enterprise fund that’s actively building out infrastructure ahead of demand. With an EDC capable of funding recruitment and revitalization efforts, Bertram offers a rare mix of affordability, growth capacity, and public-sector alignment, conditions that give private ventures a head start.

City Financial Profile

Bertram’s fiscal health is as much a strategic asset as its location.

FY 2024–25 Budget: $2.88M general fund (balanced); $5.08M enterprise fund driven by strong utility revenue and major capital projects, including a $775K State Infrastructure Bank loan for infrastructure expansion.

Revenue Model: Property tax 40.9% ($1.18M) at $0.4650 per $100 valuation on a $253.4M tax base, well below regional averages of $0.65–$0.85; sales tax 22.4% ($645K).

Development Revenue: $248K in building and subdivision permits (8.6% of general fund) plus $703K in annual enterprise impact fees, signaling sustained construction activity.

Debt: $22.5M total, concentrated in utility infrastructure; supported by $1.42M in annual water/sewer fees plus impact fees.

Economic Development Funding: EDC budget $940K; $180K sales tax base; $35K in direct business incentives; $590K reserve for recruitment and downtown projects.

Capital Position: Net position $8.68M; $22.67M restricted cash for bond projects, showing strong balance sheet management.

Takeaway: Restricted cash holdings are 2.6x the city’s annual general fund, giving Bertram unusual liquidity for a city of its size to execute capital projects without delaying for new funding approvals.

Economic Drivers

Bertram’s economy is anchored by construction, commuter income inflow, stable employers, and targeted public investment.

Construction as Growth Engine: Largest employment sector with 191 workers; 676+ homes in pipeline from CastleRock Communities and Greater Austin Builders; 6.37% job growth from 2022–2023 outpacing state average.

Commuter-Driven Incomes: 45-minute access to Austin’s $122B economy; median household income $63,750; population up 9.06% in 2022–2023, fueled by in-migration of metro professionals.

Institutional Employers: Burnet CISD with 214 FTE teachers and 3,277 students anchors education jobs; Atmos Energy maintains active local hiring.

Tourism Assets: $29,500 annual Hotel/Motel tax revenue from Globe Theatre, Flanigan’s Texas Distillery, Austin Steam Train, and new Visitor Center; part of Hill Country tourism market worth $5B statewide.

Takeaway: Construction employment now accounts for 22% of Bertram’s workforce, a concentration more than triple the state average, indicating outsized sensitivity and opportunity to building cycles.

Business Climate and Growth Indicators

Bertram’s policy framework, land availability, and infrastructure readiness are aligned to accelerate private-sector investment.

Streamlined Permitting: General Law Type A city with online GIS mapping and transparent review process.

Targeted Incentives: Business Improvement Grants (up to $8K), Matching Sign Grants, and Demolition Grants (up to $7K) on a 50/50 basis; emphasis on downtown revitalization.

Flexible Zoning: Multiple residential, commercial, and light industrial districts; ETJ expansion increasing development capacity.

Infrastructure Readiness: Added 103 acre-feet in water rights; $775K SIB loan funding utility upgrades ahead of growth.

Commercial District Investment: Downtown ground lease availability, way-finding signage, and parking improvements supporting retail and service business attraction.

Takeaway: Grant funding levels for small business improvements are 2–3x higher than typical Texas peer cities, enabling more substantial downtown upgrades per project.

Opportunity Gaps

Bertram’s rapid housing growth, commuter demographics, and limited in-town services create both higher-capital development plays and accessible, low-barrier entry points for local entrepreneurs.

Neighborhood Retail Center: Serves a 15-mile trade area of 2,500+ households, including Bertram’s 500+ new homes in the pipeline; lacks grocery, pharmacy, quick-service dining, and personal care options within city limits.

Professional Services: High-income commuter base, currently travels 30–45 minutes for banking, insurance, legal, and healthcare, leaving a clear gap for local professional service offices.

Home Services: 700 existing households plus 380 under construction generate steady demand for handyman, lawn care, home cleaning, and seasonal maintenance services, currently with minimal in-town competition.

HVAC Service: Extreme seasonal temperatures and ongoing construction create consistent installation and maintenance demand; no dedicated Bertram-based provider currently serves the market.

Takeaway: Even modest-scale businesses could capture market share quickly by meeting everyday resident needs that are presently underserved within city limits.

Closing Statement

Bertram combines fiscal strength, steady population growth, and market timing in a way that’s rare for a small city. An audited $32.3M asset base, balanced operations, and a $940K EDC budget provide the infrastructure and incentive capacity to support sustained commercial growth. With 500+ households in the development pipeline, an established tourism draw, and strategic proximity to the Austin metro, Bertram offers experienced operators a growing customer base and a competitive landscape still open for first movers.

PSA: Source links and details are moving.

Starting with this issue, I’m moving all source references out of the main article. You’ll now find them in this linked Google Folder, which keeps the briefings focused while giving you a place to dig deeper when needed.

Over time, I’ll also drop in other context interview notes, photos from site visits, etc. But, for now, it’s just the source list. If there’s anything else you’d find useful in that folder, let me know in the comments.

Next Town: Marble Falls, Texas

Have a great week! See you next Monday,

Omegadson