The North Texas Gateway City Most People Aren’t Watching | Bonham, Texas

Bonham’s strategy to turn lake-driven demand and Sherman’s chip boom into local cash flow.

Before we close out the year, I want to say a real thank you.

Texas Street published its first issue on July 28, and we haven’t missed a Monday since. That consistency only matters because you showed up for it. You read, forwarded, replied, shared ideas, and kept me honest about what this thing should be: useful, local, and grounded in real signals.

In just a few months, Texas Street has grown from zero subscribers to nearly 700, and that’s 100% because of you. You’ve been the backbone of our growth this year, and I don’t take it lightly.

As we head into 2026, my goal is simple: keep earning your attention, keep raising the bar, and keep bringing you clearer, more actionable insight on what’s happening across Texas towns and local economies.

Thank you for riding with me this first year. We’re just getting started.

Merry Christmas and Happy New Years!

With gratitude,

Omegadson

Upgrade to Texas Street All Access | $50/month| All-Access gives you statewide intelligence and a network of operators who are in the trenches with you.| Subscribe Now

Last week’s EDO Roundup…

Dec 23, 2025 — EdgeConneX drops $440M on a 578K-sf data center in Bastrop County: This one’s a monster. EdgeConneX is planning a two-story, 578,000-sf data center campus in Cedar Creek (Bastrop County) with completion targeted for June 2026.

Dec 23, 2025 — Harris County advances an $81M US 290 / Greenhouse Road overhaul in Cypress: Big mobility upgrade in the works with a new underpass and frontage road rebuild, aiming at a 2026–2030 window. A lot of the funding is federal, which helps the local math.

Dec 24, 2025 — Texas Pacific Land + “Bolt” partner on West Texas data center campuses: TPL is leaning hard into the “land + water + power” angle by partnering with Bolt Data & Energy to pursue data center campuses across its West Texas footprint. They’re putting $50M into Bolt’s $150M raise and contributing land/water rights into the model.

Dec 24, 2025 — Builders FirstSource buys into San Antonio’s new Frontera Logistics Supersite: First announced tenant at a big new industrial site off I-35. Builders FirstSource grabbed ~26 acres and is planning a ~93,500-sf facility (~$15M) that’s aiming for a late-2026 opening.

Dec 25, 2025 — New Braunfels + Boerne land ~$90M for transportation projects: Through the Alamo MPO’s TIP, New Braunfels is lined up for ~$86.35M across multiple projects, and Boerne picked up $2.6M for sidewalk work (with a 20% local match). This is the kind of stuff that quietly changes a city’s growth ceiling.

Dec 25, 2025 — Union Pacific tees up a 2,040-acre industrial mega-site near Rosenberg: UP is building an absolute scale play here: 2,040 acres with ~1,300 acres aimed at rail-served industry and capacity for 20M+ sf, plus major utility/drainage work and tons of rail storage. That’s a “come here if you’re serious” signal.

Dec 26, 2025 — Samsung lines up a $12M infrastructure revamp at its Austin semiconductor facility: Not flashy, but meaningful: Samsung is filing for a $12M infrastructure renovation tied to its Austin operations, with permitting indicating a multi-year timeline stretching out toward 2029.

Dec 27, 2025 — Bass Pro to anchor an $80M retail project in Abilene: Abilene’s Rainy Creek development is pegged at $80M on 35 acres, with a 72,000-sf Bass Pro as the anchor and another 200,000+ sf of retail planned. Classic “anchor + follow-on tenants” setup.

Dec 27, 2025 — Transwestern backs FrontierGen to accelerate AI data center + advanced manufacturing campuses in South Texas: Transwestern is partnering with FrontierGen to push “infrastructure nexus” campuses built around AI data centers and advanced manufacturing. They didn’t drop city-by-city specifics yet, but it’s another sign that megawatt-ready sites are becoming the new currency.

The North Texas Gateway City Most People Aren’t Watching…

Issue 23

B.L.U.F. Bonham is positioning itself as the service hub for two forces it did not create but can monetize: a major new reservoir project in Fannin County and a fast-rising semiconductor ecosystem in the Sherman region. The city’s near-term edge is not “charm,” it is execution, specifically zoning discipline on key corridors, utility readiness, and a financing toolkit that keeps growth costs tied to growth areas.

The risk is simple: moving rooftops faster than “daily life” capacity. If retail depth, attainable housing, and workforce upskilling lag, Bonham becomes a pass-through market instead of a sticky local economy that retains spending.

City Financial Profile

Bonham’s audited financials show a city with improving balance-sheet flexibility, paired with a tax-rate posture designed to stay competitive as the market evolves.

Balance sheet position: FY2023 ended with assets exceeding liabilities by $23,078,707 (net position). FY2023 city-wide revenues exceeded expenses by $3,401,244.

Unrestricted cushion: FY2023 includes $2,632,871 reported as unrestricted net position. This is the most flexible “shock absorber” for the primary government.

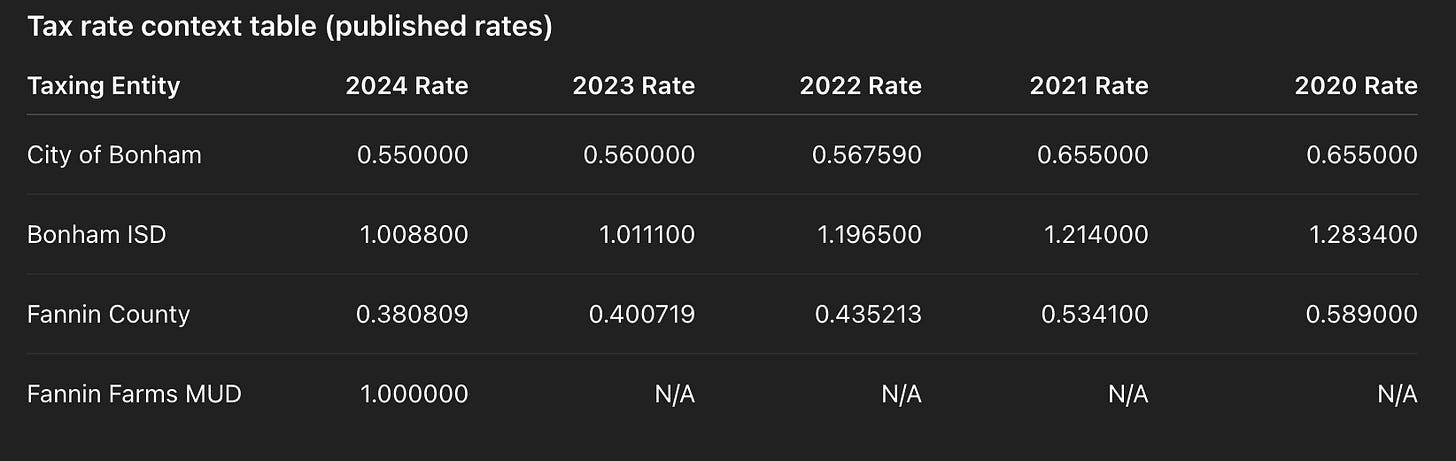

Tax rate posture: City tax rate has stepped down from 0.6550 (2020) to 0.5500 (2024) per Fannin CAD’s published rates.

M&O vs debt service signal: The FY2025-26 budget materials show an adopted tax rate $0.5500, split into $0.4016 M&O and $0.1484 I&S.

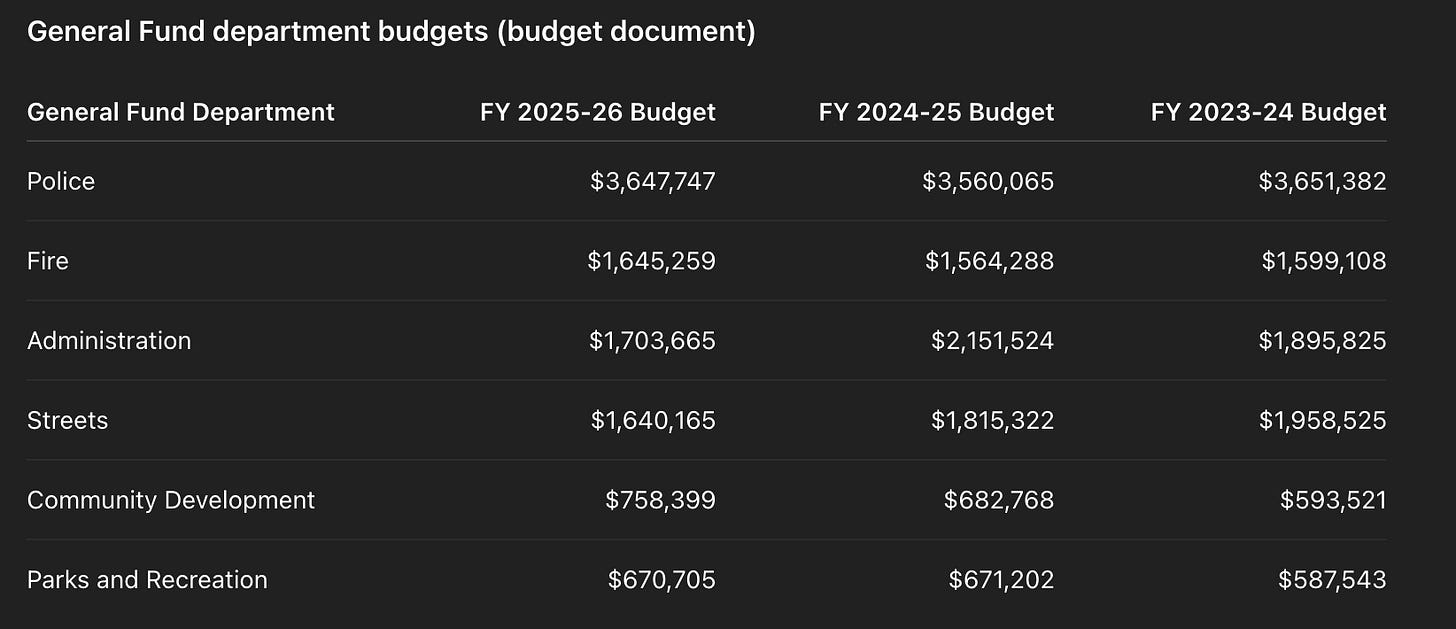

Staffing for throughput: General Fund spending shows sustained emphasis on public safety and delivery capacity, while Community Development rises over the multi-year window.

Debt load (audited): As of September 30, 2023, the city reported $26,037,425 in long-term liabilities.

Takeaway: The financial pattern is “capacity first.” Bonham is using the budget to protect service delivery while building internal throughput in Community Development, which is a quiet but real competitive advantage when residential scale arrives.

Economic Drivers

Bonham’s next decade will be shaped by water-driven development pressure and a regional manufacturing upgrade cycle tied to semiconductors.

Bois d’Arc Lake development spillover: NTMWD’s reservoir project sits just northeast of Bonham, and the economic impact work ties the lake to sustained recreational and housing development pressure in the county.

Construction-phase impact (local): The impact report estimates $509M to $563M in local economic activity in Fannin County during the construction phase (range depends on final spend).

Ongoing visitor and resident spending: The same report projects $16.748M to $21.982M in annual recreational visitor spending, and estimates resident-driven economic activity in the $105.294M to $116.378M range annually (five-county framing in the summary).

Housing pressure around the lake: The report estimates 1,100 new full-time households plus 2,100 weekend or second homes over a 30-year period around the lake area.

Sherman semiconductor “halo”: Major semiconductor-related investments in Sherman (Texas Instruments and GlobalWafers announcements) are reshaping the labor shed and supplier map for the region.

Existing manufacturing base: Bonham is not starting from zero. The city’s “Major Industries” list includes manufacturers tied to energy systems, metal fabrication, housing, and specialty products.

Takeaway: The lake is a demand engine, and Sherman is a wage engine. Bonham wins if it becomes the “service economy with standards” that captures spending, not just rooftops.

Business Climate and Growth Indicators

Bonham’s posture is actively pro-growth, with clear signs of corridor protection, a modernizing development process, and financing structures designed to keep expansion feasible.

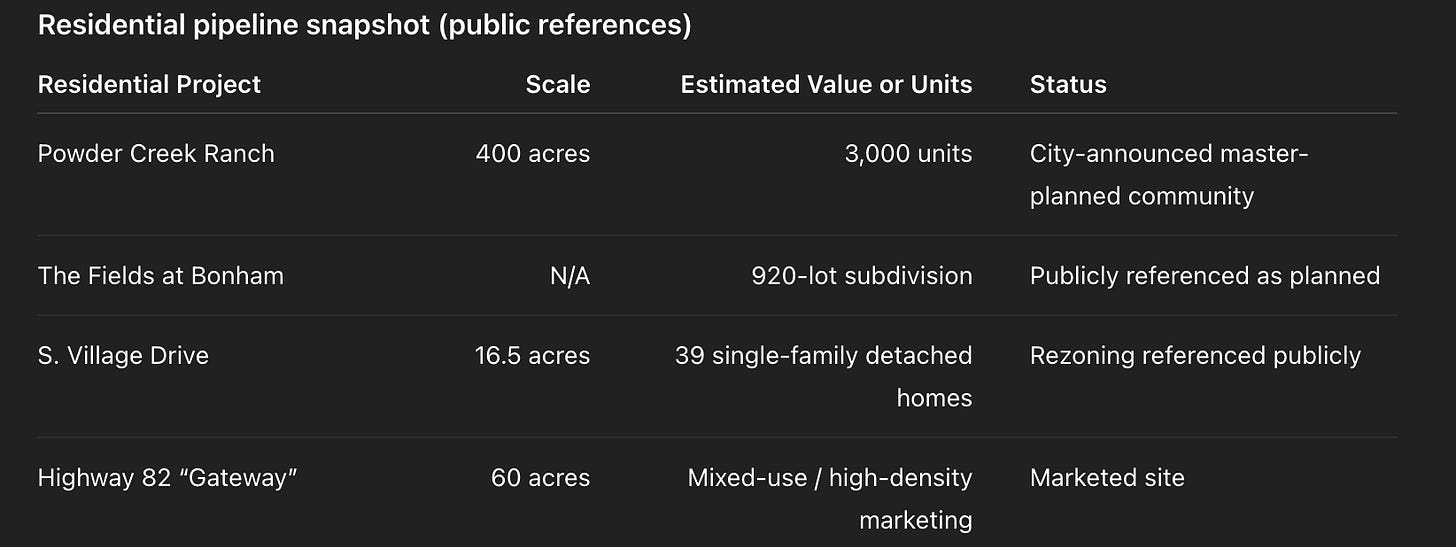

Master-planned scale is real: Powder Creek Ranch is presented by the city as its first master-planned community, planned at 3,000 residential units over phased buildout.

Development finance tool adoption: Public Improvement District (PID) actions tied to Powder Creek Ranch show the city is using Texas growth-finance tools to align infrastructure costs with benefiting properties.

Corridor zoning discipline: The city approved a “Corridor Commercial District” concept for key highway frontages, aimed at shaping what lands on high-visibility routes.

Permitting modernization: The city operates an online permitting and applications workflow, which reduces friction for scaled builders.

EDC structure and incentive tools: BEDCO is structured under Texas EDC rules and publishes an incentive menu including grants, loans, infrastructure assistance, and training support.

Takeaway: The city is building the “rules and rails” for growth: corridor zoning, permitting systems, and district finance. That reduces the risk of chaotic frontage development and raises the odds that new households turn into durable tax base.

Opportunity Gaps

Bonham’s upside increases if it fills three gaps fast enough that rooftops convert into retained spending, attainable housing options, and a more competitive workforce profile.

Opportunity 1: Corridor Retail Node Strategy

Market Opportunity: Package 1 to 2 “ready” retail nodes on Highway corridors with clean zoning, utilities, and pad-ready parcels to attract grocery-adjacent and daily-needs tenants.

Need / Gap: The city’s own vision language prioritizes stronger retail and active corridors, which implies a capture problem that should be solved with site readiness and tenant targeting.

Opportunity 2: Missing-Middle Workforce Housing Product

Market Opportunity: Build a “middle” housing program, small lots, duplexes, cottage courts, and build-to-rent that fits local wages and supports the VA and manufacturing workforce.

Need / Gap: Large master-planned communities expand supply, but they do not automatically create attainable options. Without missing-middle product, workforce retention becomes harder even as jobs remain local.

Opportunity 3: Semiconductor-Adjacent Workforce Bridge

Market Opportunity: Stand up a targeted training bridge with nearby colleges for industrial maintenance, cleanroom-aware trades, QA, and advanced manufacturing roles that align with the Sherman chip ecosystem.

Need / Gap: The city markets education and workforce assets, but the regional labor market is upgrading fast. Bonham gains leverage if it can credibly supply skilled talent, not only housing.

Takeaway: These three moves help Bonham keep money local. They also reduce “growth drag,” the hidden cost of growth when residents must drive elsewhere for essentials, when workforce cannot find housing, and when employers outbid each other for the same limited skills.

Closing Insight

Bonham is not betting on one project, it is stacking multiple demand streams and building governance capacity to manage them. The differentiator will be speed with standards: fast approvals, corridor discipline, and finance tools that protect the base while enabling the edge. If the city pairs that with a deliberate retail and workforce strategy, it can become the place where growth sticks, not just the place where growth sleeps.

Upgrade to Texas Street All Access | $50/month and, in addition to this weekly brief, access…

Texas Street Trends, a premium monthly deep-dive covering the biggest economic, infrastructure, and industry shifts in Texas. If you’re trying to see early signals, spot risks before they hit Council, or stay ahead of competing cities, this is for you.

Subscriber-only playbooks, templates, and charts you can plug straight into your next pitch, briefing, or strategy session.

Texas Street Connect, a private community for Texas EDO leaders and local decision makers. A place to share what’s working, compare notes, ask questions, and get clarity fast. [Launching January 1st, 2026]

You’re no longer doing this alone.

All-Access gives you statewide intelligence and a network of operators who are in the trenches with you.

$50/month. Cancel anytime.

The first 30 founding members will help shape the community from day one.

Next Town: Stephenville, Texas

Have a great week! See you next Monday. Happy New Years!

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Whenever you’re ready, EDO leaders…

Strategy Session w/ me; focused 30-minute meeting designed to quickly align on goals and priorities. You can expect crisp insights, well-defined next steps, and an actionable plan to move your strategy forward in a concise, decision-driven format.