Bowie, Texas Wins When It Says No...

Saying no to oversized deals is the plan. Bowie wins by funding basics, tightening permitting and airport governance, and backing operators who fit its scale.

“Say no more often. Fund basics. Right-size deals.”

Go Premium - Get Texas Street Trends

Upgrade to get the first report: Wednesday, November 5th, 2025

Unlock Texas Street Trends

Every first Wednesday of the month, you’ll get:

A monthly deep dive on the technologies reshaping Texas: AI, compute, energy, logistics, biotech, and more.

Data-backed visuals that make complex trends easy to explain

City-level insights you can use in meetings, pitches, and planning

Full access to the Trends archive as it grows

Timely Coverage: delivered once a month with clarity you can act on.

Last week’s EDO clips…

Texas data-center buildout is starting to ripple through local business (Oct 6, 2025)

Quick read on how AI/data demand is spilling over into suppliers and small businesses. Good nudge to tighten your power/permits one-pager.Eaton turns on a $100M expansion in Nacogdoches (Oct 8, 2025)

They’ve more than doubled U.S. output of grid gear exactly the kind of capacity Texas utilities need. Nice proof point for advanced manufacturing.Weslaco greenlights a $6M retail plaza by H-E-B DC (Oct 8, 2025)

About 24k sq ft across three buildings and ~140 jobs expected. Solid “follow the anchor” move near the distribution center.Tesla plans a $10.4M sales & service hub in New Braunfels (Oct 9, 2025)

47k sq ft along I-35 between Austin and SA. Keep an eye on contractors and EV-adjacent suppliers who may cluster nearby.Travis County launches a $21M child-care program to boost workforce (Oct 9, 2025)

Scholarships + provider support aimed at getting more parents into the labor force. Useful model to watch for participation gains.Galveston to build three U.S. Coast Guard icebreakers (Oct 10, 2025)

Big maritime win with thousands of skilled trades jobs in the mix. Great moment to align training with shipbuilding needs.Base Power sets up a battery assembly footprint at the old Statesman site (Oct 12, 2025)

Temporary reuse turning into a real clean-energy beachhead. Good example of activating idle space for manufacturing.Target & Walmart file $40M+ in Texas store upgrades (Oct 12, 2025)

Renovations signal fresh retail investment; perfect time to pair with façade grants and small-area fixes to lift nearby corridors.

Bowie Wins When It Says No…

Issue 13

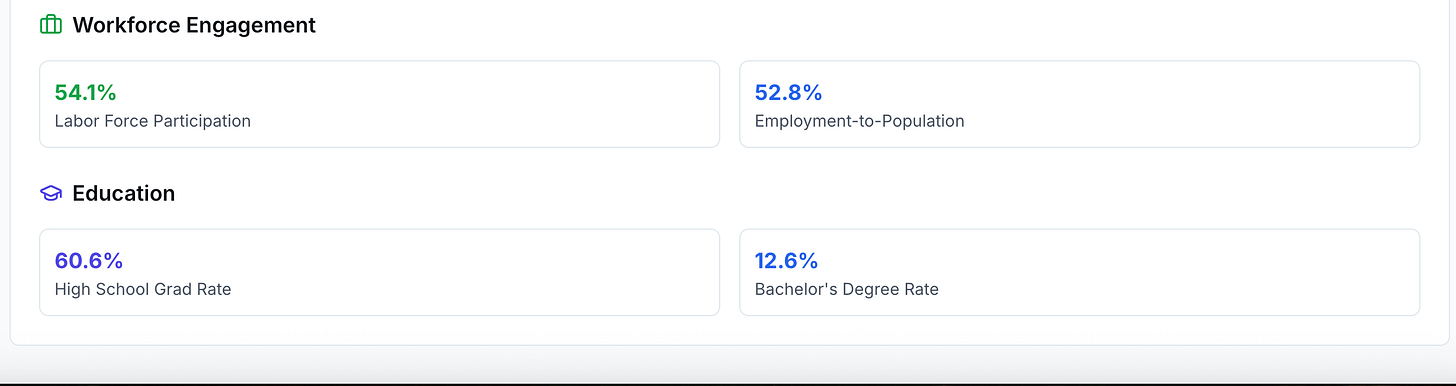

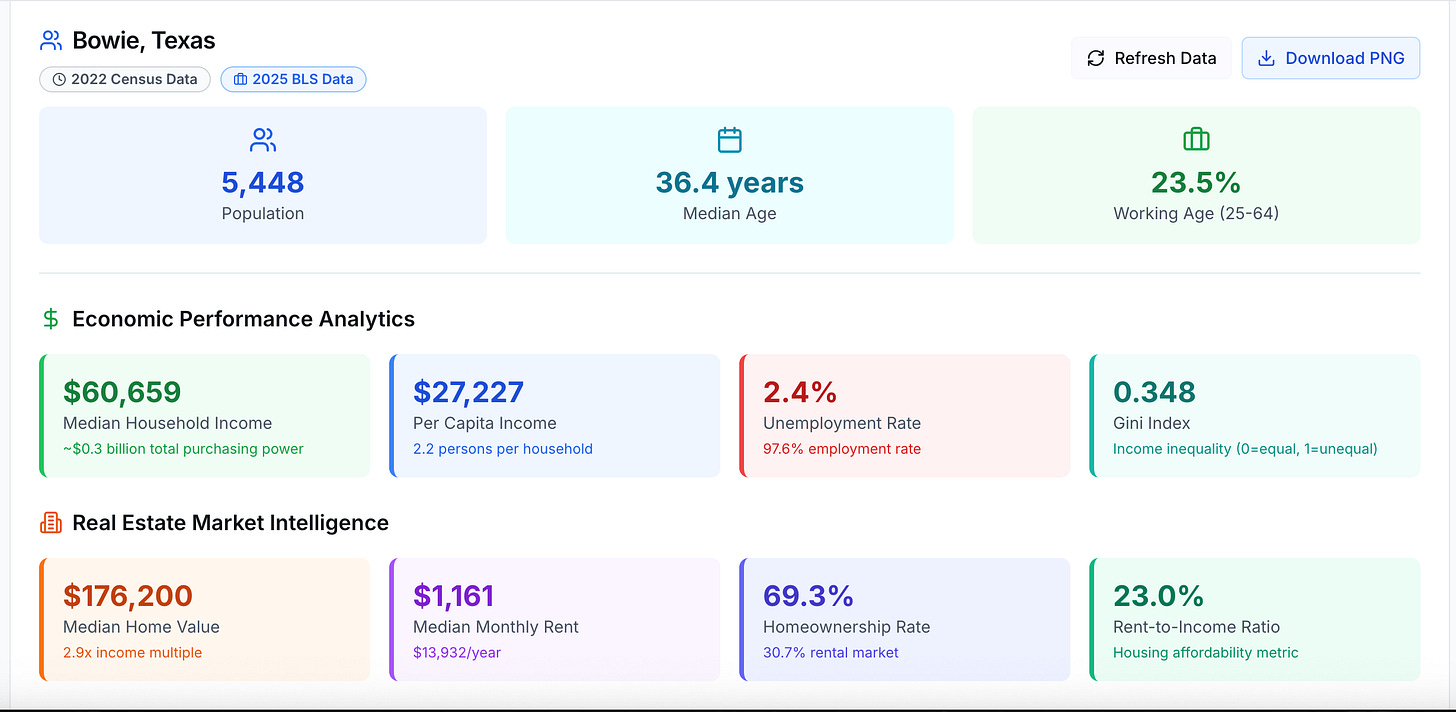

B.L.U.F. Bowie is a lean, utility-owning small city with a stable tax rate and a modest general fund. The city’s FY2025 property tax rate holds at $0.5430 per $100, supported by a taxable base of about $476.5M. General Fund revenues total roughly $10.72M, with taxes at just over $4.0M.

The local economy leans on legacy manufacturers like American Hat Company and WL Plastics, a regional Walmart, and the school district. Healthcare access is fragile after hospital closures and a short-lived ER reopening. The airport and US 81/US 287 access are strategic assets, but governance and permitting capacity need attention.

City Financial Profile

Bowie manages a small-city budget with steady rates and utility operations that matter.

Property tax rate: $0.5430 per $100, unchanged for multiple years. Assessed valuation for FY2024-25, $476,516,209. Estimated levy, ~$2.59M.

General Fund revenues: $10,719,066. Taxes, $4,044,533; charges for services, $3,078,893; intergovernmental, $75,000; other categories as shown in budget.

Tax rate history: roughly flat near $0.543 over the last several years.

Utilities: City operates electric, water, sewer, sanitation as enterprise functions. Example, Electric Fund FY2025 budget request totals ~$7.35M; Utility Fund projected ending net position ~$8.14M with significant restricted balance.

EDC funding: Bowie has both Type A and Type B EDCs using dedicated 0.5% + 0.5% sales tax.

Takeaway: Bowie’s fiscal posture is small but steady. The tax rate is stable, the base is under $500M, and utility operations are central to service delivery. Any growth strategy must fit within this scale, prioritize utility reliability, and avoid commitments that outpace the revenue base.

Economic Drivers

A concentrated set of employers anchors the economy.

Manufacturing: American Hat Company (Bowie HQ, active hiring) and WL Plastics (HDPE pipe plant) remain brand-recognizable anchors.

Retail trade area: Walmart serves as a regional draw for surrounding rural areas.

Education: Bowie ISD is a top local employer (district-level data not centrally published on headcount by campus; treat as a stabilizer).

Healthcare: Hospital closed in 2015, briefly reopened in 2017, re-closed in 2020; a freestanding ER opened Oct 2023 and closed Oct 2024. Access now routes to nearby systems.

Logistics access: Bowie sits on US 81/US 287 with a municipal airport offering 100LL and Jet-A, runway about 3,600 feet.

Takeaway: Manufacturing heritage plus regional retail and school district stability keep a floor under Bowie’s economy. Healthcare volatility is a headwind, and sector diversity is limited. Logistics proximity is an underused lever.

Business Climate and Growth Indicators

Intent is supportive, capacity is thin.

Incentives: City maintains Type A and B EDCs funded by sales tax, standard in Texas for project support.

Permitting capacity: Plan reviews handled by Bureau Veritas; the city schedules inspections Mon–Thu cutoffs, which can add friction for complex projects.

Airport governance: The Airport Board currently lists no active members, pointing to an under-managed asset.

Zoning/governance: Boards and commissions structure exists, but staffing and volunteer bench look thin.

Takeaway: The policy toolbox exists, but execution capacity is the constraint. Smoother plan review, an active airport board, and targeted infrastructure planning would materially improve the development experience.

Opportunity Gaps

Three near-term, operator-friendly plays that fit Bowie’s scale.

Healthcare access services

Market opportunity: Urgent care, imaging, PT, behavioral health partnerships.

The gap: Hospital and ER instability has created leakage to neighboring cities.

Utility-adjacent field services

Market opportunity: Leak detection, meter change-out contractors, trenchless repairs, lift-station service, and private septic where appropriate.

The gap: City utilities are critical and capital-intensive, and the budget shows ongoing enterprise needs that private vendors can complement.

Aviation-light logistics

Market opportunity: Small-footprint distribution, MRO light shops, and time-sensitive freight staging leveraging US 81/US 287 and the municipal airport.

The gap: Runway and fuel are in place, but governance is inactive, and the asset is under-programmed.

Takeaway: These moves raise service availability without oversizing risk. They monetize existing assets, reduce leakage, and keep new public costs modest.

Closing Insight

Bowie’s constraint is not intent, it is capacity. Wins will come from projects that match the city’s fiscal scale, lighten utility burden, and professionalize the airport and permitting touchpoints. In a town this size, one good operator in each gap can shift outcomes faster than a large, subsidy-heavy bet.

Source links…

Available here: this linked Google Folder.

Social highlights….

This week’s Sponsor… LEIP - ai powered workspace EDOs

LEIP is an ai powered workspace built for Economic Development Organizations.

Let LEIP take care the busy work and free up REAL team.

Next Town: Mason, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.