Cedar Park’s $204M Budget & $400M Pipeline: A Growth Blueprint. Here’s How...

$400M+ in projects and an aerospace + tech cluster are reshaping Cedar Park’s role in Central Texas.

“Every data point is a number, until you turn it into a narrative people can believe in.”

This week’s Sponsor… Katie Milton Jordan

EDO leaders: AI is already changing how you read city data, build stronger pitches, and plan faster.

I’m opening a free $4,000 AI Scholarship for one leader who wants to level up now. It includes:

AI Certification

A 30-day AI MBA trial with 3,276 pre-built workflows

If you’re ready to future-proof your community and leave a real AI legacy, let’s talk.

Book a 15-min Free Upgrade Call Or email: katie@katiemiltonjordan.com

Issue: 06

B.L.U.F.: Cedar Park has moved from bedroom community to economic hub. With a $203.6M FY2025 budget, a stable tax rate, and $400M+ in active projects, the city is combining fiscal discipline with targeted recruitment in aerospace, technology, and life sciences. The result: a high-growth city that’s deliberately positioning itself as the northwest anchor of the Austin metro.

Cedar Park’s transformation isn’t accidental.

Once known as a commuter suburb, it is now a regional employment center.

Deliberate policy choices, targeted incentives, and infrastructure investments have created the conditions for aerospace, technology, and advanced manufacturing companies to scale here.

The city’s ability to fund growth while maintaining a stable tax rate makes it one of the most financially disciplined examples of suburban economic development in Texas.

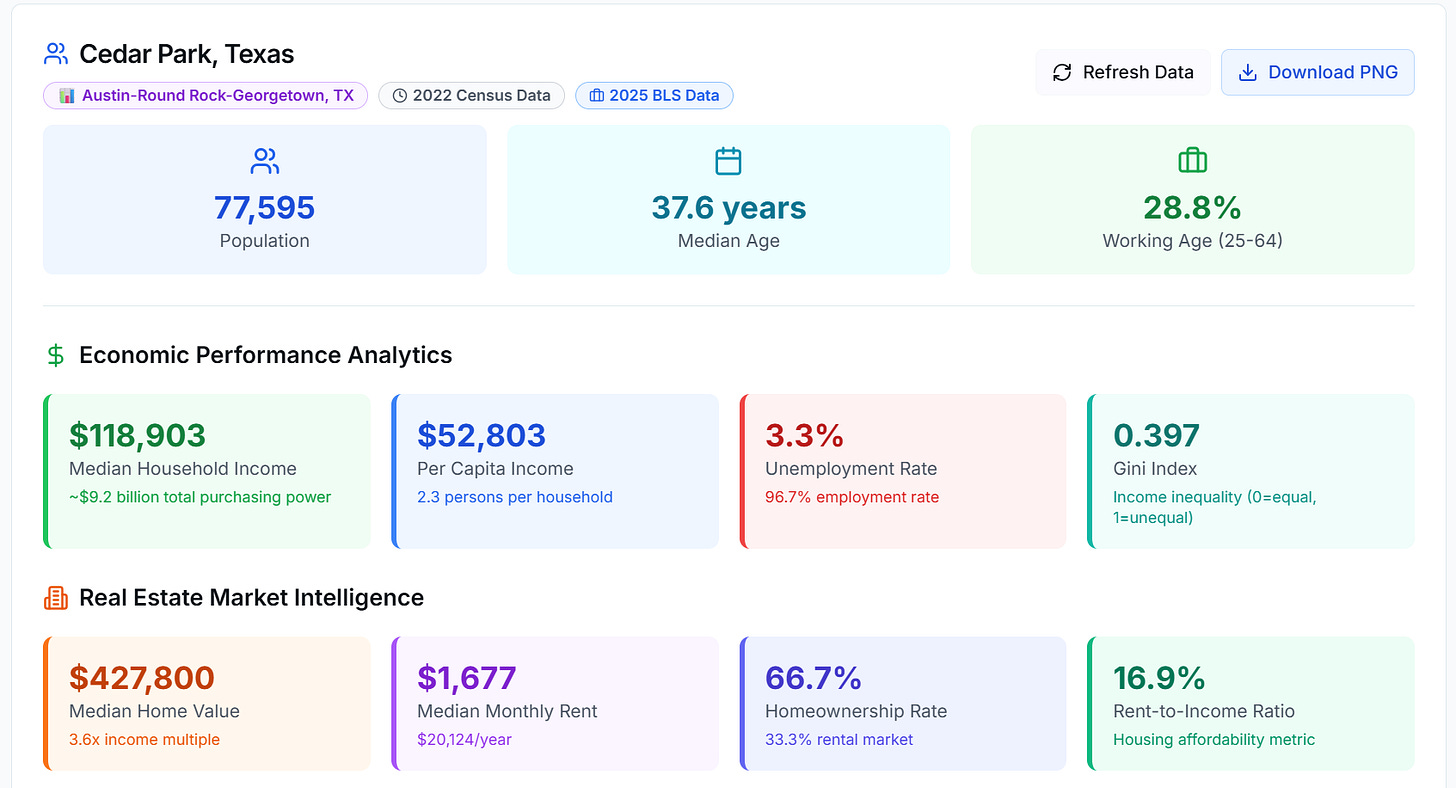

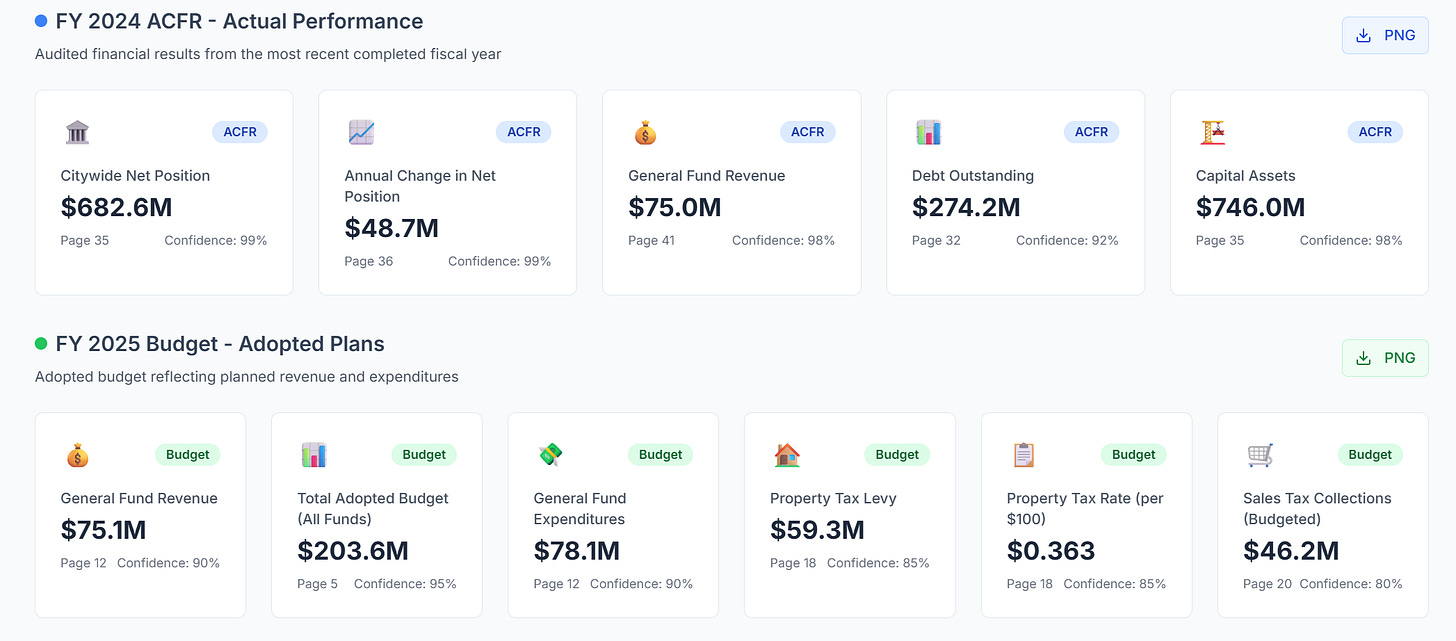

City Financial Profile

Cedar Park demonstrates exceptional financial strength with a proven track record and ambitious growth plans.

Takeaway: The city's FY 2024 audited results show a robust net position of $683M with a positive annual change of $49M, reflecting strong fiscal management. Looking ahead, the FY 2025 adopted budget totals $204M with a general fund of $75M, positioning the city for continued growth and strategic investment opportunities.

Economic Drivers

Cedar Park’s employment base has shifted from commuters to clusters.

Aerospace, technology, and life sciences now form the city’s backbone, supported by a well-educated workforce and industrial anchors.

Aerospace: Firefly Aerospace anchors the sector from its Cedar Park HQ with 700+ employees, fresh off a 2025 lunar landing under NASA’s CLPS program and a summer 2025 public listing that valued the firm at ~$5.5B.

Technology: Hyliion (EV tech) and ETS-Lindgren (EMC systems) continue to grow high-wage R&D and advanced manufacturing jobs.

Life Sciences: Enovis is investing $25.5M in a 100,000-SF facility creating 162 jobs at $65K average wages, supported by up to $650K in incentives and an employee relocation bonus of up to $10K per purchase.

Industrial base: Established manufacturers like CoreSlab Structures and Texas Quarries provide stability alongside newer clusters.

Corporate HQ functions: A growing number of companies are selecting Cedar Park for HQ operations, leveraging metro access at a lower cost point.

Takeaway: Cedar Park’s economic base isn’t just about proximity to Austin. It’s about deliberately recruiting high-value industries that align with regional strengths while creating career pathways for its highly educated workforce.

Business Climate & Growth Indicators

The city has created a business environment designed for speed.

Projects move faster, land is ready, and incentives are structured to close deals without red tape.

Regulatory efficiency: Fast-track approvals, required pre-development meetings, and performance-based incentives reduce friction. Executives have direct access to city leadership.

Infrastructure momentum: The New Hope Industrial Park is a ~$250M mixed-use/industrial project with 430,000+ SF of industrial space planned. The New Hope Drive extension is underway, with bridge milestones hit in 2025 and staged completion into 2026.

Active development pipeline: Over $400M in projects under construction, including the $31M Bell District library + mixed-use, a 64,000-SF retail/office project with entitlements that could include a 13,500-SF Trader Joe’s, and the $95M CedarView Marriott hotel (297 rooms) with 50K SF convention center now under construction (delivery Feb 2027).

Zoning modernization: Strategic rezoning along growth corridors is opening land for commercial and mixed-use projects that support walkability and transit-oriented development.

Incentives: Cedar Park deploys Type A/Type B performance grants, Chapter 380 rebates, 10-year abatements, and training reimbursements; select projects (e.g., Enovis) also include employee relocation bonuses.

Takeaway: Infrastructure readiness, streamlined approvals, and competitive incentives make Cedar Park a low-friction choice for companies weighing the Austin region.

Opportunity Gaps

Cedar Park’s rapid growth has created room for service providers and niche operators who can fill the gaps around its larger industry clusters.

Advanced Manufacturing Support: Firefly, ETS-Lindgren, and Enovis create demand for suppliers, component makers, and testing services. The New Hope Industrial Park offers 430,000+ SF of space suited for these needs.

Corporate Housing & Executive Services: 200+ new high-wage jobs per year are driving demand for furnished housing, relocation services, and executive amenities. City programs even offer relocation incentives of up to $10K per employee purchase.

Tech-Enabled Community Services: A young, educated population and walkable new districts are driving demand for co-working with childcare, smart wellness services, and edtech tied to local schools.

Takeaway: The biggest gaps aren’t in heavy industry; they’re in the services surrounding growth. Companies that can meet the needs of new workers, executives, and residents will move fastest.

Closing

Cedar Park is one of Texas’s clearest examples of deliberate economic transformation.

With a steady tax rate, strong reserves, and a diversified base in aerospace, tech, and life sciences, the city shows how intentional policy can turn a suburb into a regional hub.

For you, the lesson is straightforward: when fiscal discipline meets targeted industry recruitment and infrastructure readiness, you create leverage in a competitive region.

Source links and details have moved…

You’ll now find them in this linked Google Folder. This keeps the briefings focused while giving you a place to dig deeper when needed.

Over time, I’ll also drop in other context interview notes, photos from site visits, etc. But, for now, it’s just the source list. If there’s anything else you’d find useful in that folder, let me know in the comments.

Let me buy you coffee for a week… you pick the shop.

Why?

I need 3 people willing to share 45 minutes of their time.

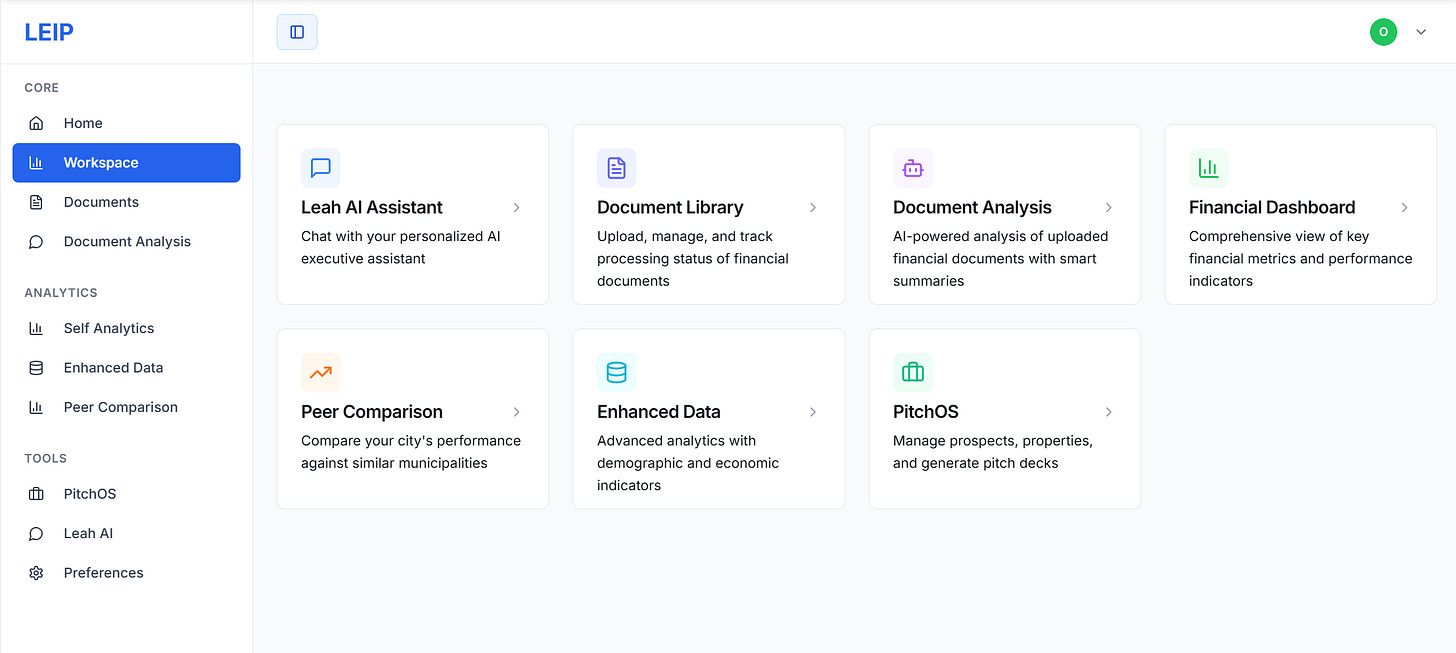

Here’s the deal: most EDO teams don’t have the budget for a big staff. I’m building an AI-powered executive assistant for EDOs (you saw a couple snippets earlier), a way to give smaller teams an extra set of hands without breaking the budget.

But I don’t want to build this in my own little bubble.

I want your voice in it.

If you’re willing to share what would actually help your day-to-day, I’ll take your input over a week of coffee any day.

Interested? I’d love your perspective. Respond directly to this email.

Okay, let’s wrap things up. Here are 3 posts that caught my attention this week…

Next Town: Lampasas, Texas

Have a great week! See you next Monday.

Oh, one more asks, help us continue to grow. Share Texas Street with someone you think will benefit; your support makes all the difference.

Grateful,

Omegadson

P.S. Don’t forget to connect with Texas Street on LinkedIn and Facebook.