The High-Leverage Growth Model | Celina, Texas

How Celina uses debt, rooftops, and resident affluence to pre-fund infrastructure, pull in regional anchors, and turn breakneck growth into a self-financing engine.

Code #1: Protect the Mission, Not the Moment

Never trade long-term economic health for a short-term headline.

Upgrade to Premium for $50/month and, in addition to this weekly brief, access…

Monthly Texas Tech Brief that turns AI, energy, logistics, and other trends into clear, city-level impact.

Subscriber-only playbooks, templates, and charts you can plug straight into your next pitch, briefing, or strategy session.

Membership to Connect by Texas Street, a private community for Texas EDO leaders and local decision makers [Coming Soon]

Unlock $5,000 big-firm insights for a fraction of the cost while keeping the weekly Briefs free.

Last week’s EDO Roundup…

Mexican Manufacturer Puts $50M Aluminum Plant In Mission (Nov 17, 2025)

Century Recycling out of Mexico is putting $50M into a 98,000 sq ft aluminum recycling and manufacturing plant on the south side of Mission near the Anzalduas bridge. They’re talking about ~70 permanent skilled jobs plus around 240 construction jobs, which quietly strengthens Mission’s metals cluster and cross-border story.

Taylor Lands First Phase Of iMarketAmerica At Gradiant Technology Park (Nov 18, 2025)

Taylor EDC locked in iMarketAmerica as an early anchor at Gradiant Technology Park with an initial 267,000 sq ft flex/industrial phase on about 35 acres and more than 2.2M sq ft planned at full buildout. It’s framed as a $45M+ first-phase investment that should turn into several hundred jobs as additional buildings come online.

Temple EDC President To Chair 2026 Texas Economic Development Council Board (Nov 18, 2025)

Adrian Cannady from Temple EDC has been tapped to serve as 2026 Chair of the Texas EDC Board. It’s a reminder that cities like Temple have outsized influence on how incentives and statewide programs actually get interpreted on the ground.

Cancoil Wins TEF Grant For New Manufacturing Plant In Jacksonville (Nov 20, 2025)

Cancoil USA is setting up a new U.S. manufacturing facility in Jacksonville with $28M+ in capital investment and 120 new jobs. The state sweetened the deal with a $648,000 Texas Enterprise Fund grant plus a $10,000 Veteran Created Job Bonus, giving Jacksonville a solid new industrial anchor.

Panola College Awarded $298,861 TWC Grant For Dual Credit Healthcare Training (Nov 20, 2025)

Panola College landed just under $300K from the Texas Workforce Commission to expand dual-credit CNA and Patient Care Tech programs across 12 ISDs. High school students get tuition, scrubs, exam prep and certifications covered so they can step straight into local hospitals, clinics and long-term care jobs.

Texas Energy Fund Backs 455 MW NRG Gas Plant In Houston (Nov 20, 2025)

NRG is getting a TxEF loan of up to $370M (20 years at 3%) to build a 455 MW natural gas unit at Greens Bayou in Harris County, with total project costs under $617M. It’s one more signal to large power users that Texas is actually financing firm capacity, not just talking about it.

SpaceX Seeks Up To $7.5M In Enterprise Zone Tax Breaks For Starbase Projects (Nov 20, 2025)

The Starbase City Commission moved to nominate two big SpaceX projects – the $506M GigaBay rocket factory and a $480M launchpad expansion – for Texas Enterprise Zone status, opening the door to up to $7.5M in state sales tax refunds. Together they’re talking about nearly $1B in spend and at least 1,000 new full-time jobs ramping through 2027.

The High-Leverage Growth Model…

Issue 19

B.L.U.F. Celina runs a high-leverage growth model. The city carries about $602.6 million in tax-supported debt while keeping its FY 2026 property tax rate at $0.576401 per $100 of value and growing the total budget to $382.7 million, up 4.5% year over year. That debt is backing roads, water, sewer, and capital projects that are sized for a much larger future city, not just today’s population.

The bet is working so far.

More than 88% of the $9.7 million increase in property tax revenue for FY 2026 comes from new construction rather than higher taxes on existing owners, and S&P has affirmed an AA GO rating with a Positive Outlook based on strong revenue growth and management. At the same time, a median household income near $155,875 and a homeownership rate over 90% signal an extremely affluent, stable resident base that is still driving big-box retail and healthcare anchors to follow the rooftops.

Celina is one of North Texas’s clearest examples of what happens when a small town chooses to get in front of growth instead of reacting to it. City leaders are using large, planned rounds of debt and a detailed five-year capital program to lock in water, sewer, and mobility capacity ahead of demand, then using that platform to attract regional employers and high-end retail.

City Financial Profile

Celina’s financial profile is built around a simple idea: let rapid growth in the tax base, not higher tax rates on existing residents, carry the load for big infrastructure.

Budget Scale and Growth

The adopted FY 2026 total budget is about $382.74 million, up 4.5% from FY 2025. That is an increase of roughly $16.4 million year over year. The city is adding staff and services for police, fire, EMS, and parks, but is keeping operating growth measured relative to its surge in population and service demand.Tax Rate Strategy, Revenue Driven by New Construction

The total property tax rate for FY 2026 is $0.576401 per $100, down from $0.598168 the prior year. On paper, that is a tax cut. In practice, total property tax revenue still climbs by 22.59%, or $9.73 million, because of new value on the tax roll. About $8.58 million, roughly 88% of that increase, comes from new properties added in the last year, not from raising bills on existing owners.Debt Load and Structure

Celina has about $602.61 million in debt secured by property taxes. The debt service portion of the tax rate is $0.311473, which is about 54% of the total rate. In other words, more than half of every property tax dollar is currently reserved for paying bondholders.External Credit Check on the Strategy

S&P Global Ratings recently affirmed the city’s general obligation rating at AA and revised the outlook from Stable to Positive, citing sustained tax base expansion, strong management, and a robust local economy. A Positive Outlook signals that, if performance continues, an upgrade is possible and that the market currently views Celina’s high-debt strategy as manageable.Capital Program, Heavy Focus on Utilities and Mobility

Celina issues debt each year to fund its capital improvement projects. Its adopted Five-Year Capital Improvement Program for FY 2025–2029 lays out a pipeline of roads, water and wastewater lines, elevated storage tanks, parks, and public safety facilities. City materials stress that keeping up with water, sewer, and road capacity is the primary driver of capital spending, and that capital plans are coordinated with the annual budget.Growth-Linked Fiscal Risk

The core risk is that this model relies on continued, high-velocity growth in taxable value. The city is on pace to issue more than 2,600 single-family permits in FY 2024, and its five-year CIP assumes continued strong growth to support long-term projects. Any prolonged slowdown in new construction or regional housing demand would tighten the cushion between pledged revenues and debt service. The current AA rating with Positive Outlook suggests this risk is acceptable at today’s growth rates, but it is still the key variable to watch.

Takeaway: Celina has chosen a high-debt, high-growth fiscal model and, so far, the math works. New rooftops, not higher tax rates, are paying for a large share of debt service, which lets the city build out big-ticket infrastructure years before many peer cities.

Economic Drivers

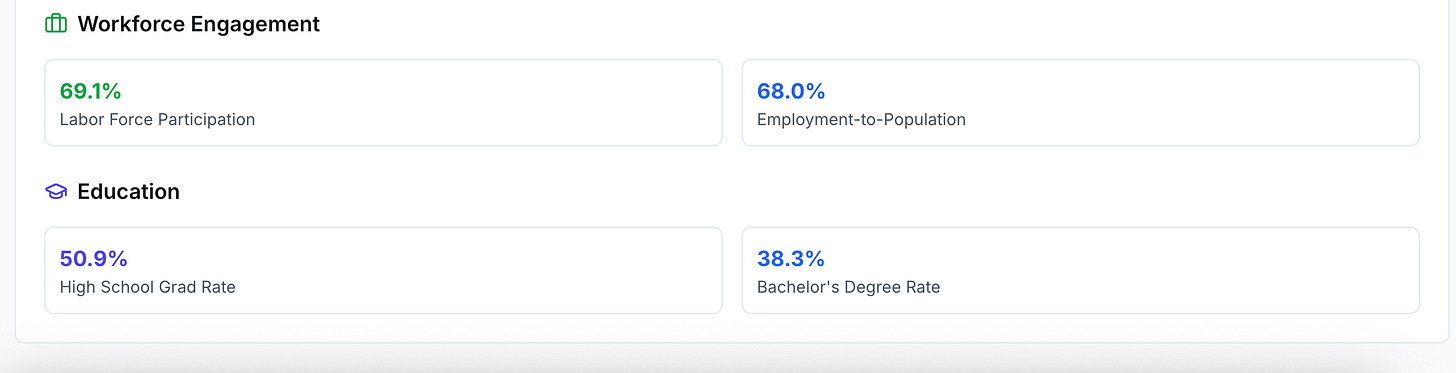

Celina’s economic engine is still led by people rather than employers, but that is starting to change as healthcare, big-box retail, and services chase the city’s income profile.

Affluent Resident Base as the Primary Engine

Median household income in Celina is about $155,875, one of the highest figures among Texas cities of similar size. Homeownership sits around 93.2%, and the median property value is roughly $458,000. This points to a community of high-earning, asset-heavy households that can support premium goods, services, and experiences.Historic Public-Sector Anchors

For years, the largest employers in Celina have been public and education institutions such as Celina ISD, the City of Celina, and Collin College. These anchors create stable baseline employment, but they do not fully absorb the spending power or workforce capacity of a fast-growing, high-income community.Arrival of Major Retail and Healthcare Anchors

Celina’s affluent demographics have now attracted large-format retail and healthcare. A Costco warehouse club and other national brands are locating along key corridors, and Methodist Celina Medical Center, the city’s first full-service hospital, is coming online as a regional healthcare anchor. Together, these projects introduce hundreds to thousands of jobs and reduce the need for residents to travel to neighboring cities for basic and specialized services.Evidence of Regional Leakage

The average commute time of 32.3 minutes suggests that many residents still travel outside Celina for work, shopping, dining, and professional services, often heading toward US 380 and other DFW employment and retail hubs. That commute pattern signals continued leakage of high-value spending and is one reason large private projects are now moving into Celina’s trade area.Local Business Retention and Startup Support

The Celina Economic Development Corporation is investing in business support programs that focus on retention, workforce development, and mentorship for local startups. City leaders have publicly framed this as a way to help existing businesses benefit from growth rather than be displaced by it, and to ensure a skilled workforce is available as larger employers arrive.

Takeaway: Celina is in the middle of a pivot from “rich bedroom community” to a more self-contained employment and service center. The resident base already proves the market. The question now is how quickly local jobs, healthcare, and services can catch up so that fewer dollars bleed out to other DFW suburbs.

Business Climate and Growth Indicators

Celina’s development pattern is a mix of sheer volume in master-planned housing and fine-grained control in its historic core and future corridors.

Residential Permits as the Leading Indicator

The city is on track to issue more than 2,600 single-family permits in FY 2024, up from 2,220 the year before. At the same time, the population is projected to grow from 43,039 to 54,054 in FY 2025. That pace sets the floor for construction trades, suppliers, and home services and also underpins the tax base growth that supports the city’s debt strategy.Zoning Pattern, Strong Single-Family Share

Zoning maps show that about 21% of land area is designated for single-family housing, with additional land set aside for multifamily and communal housing. This confirms that the city has consciously reserved large areas for residential build-out, while still leaving space for future mixed-use and commercial nodes.Downtown Controls for Character and Placemaking

Celina uses a Downtown Code and master plans that set clear expectations on building form, density, and aesthetics in the historic core. The goal is to protect small-town character while encouraging mixed-use, walkable development that can function as an “entertainment district” and local destination. This adds complexity for some projects but also creates a high-quality canvas for experiential retail and dining.Managed Growth in the ETJ and Master-Planned Communities

Outside the core, the Planning Division manages large-scale plats, zoning and site plans for master-planned communities and commercial sites. Review processes are set up to keep large developments moving while aligning them with the city’s comprehensive plan and infrastructure master plans.Collin County Outer Loop as a Long-Term Growth Spine

The Collin County Outer Loop is a planned multi-modal corridor that will eventually encircle parts of the county and relieve congestion on US 380. One key segment runs through the Celina area, with frontage roads built ahead of main lanes and a reserved center corridor for future transit. This corridor is already shaping development, with large tracts and master-planned communities positioning along its path in anticipation of future traffic and logistics demand.Geographic Focus: Preston Road, Downtown, and the Outer Loop

Current commercial activity is concentrated along Preston Road (US 289) and in the Downtown Core. Preston Road captures high-volume, auto-oriented trade, including new shopping centers and national brands. Downtown focuses on smaller-scale, higher-margin experiences. The Outer Loop and nearby ETJ areas function as the future growth frontier for logistics, employment, and additional master-planned housing.

Takeaway: Celina combines volume and control. It is issuing thousands of housing permits per year while also using master plans, a Downtown Code, and the Outer Loop corridor to steer where jobs, retail, and services go. For investors and business owners, the safest near-term bets are on Preston Road and Downtown, with longer-dated plays along the Outer Loop as infrastructure phases in.

Opportunity Gaps

Celina’s affluent residents and rapid build-out have created clear gaps between what people can afford and what is available locally. Below are three specific, data-backed opportunities.

High-End, Niche Specialty Retail and Experiential Dining

Market Opportunity: Tap into a median household income of about $155,875 and a resident base that already owns higher-value homes and has the means to spend on premium experiences. Anchors like Costco and national chains will cover mass-market demand, but there is room for independent, higher-margin concepts in food, retail, and services that match the lifestyle of $450k-plus homes.

Gap: Many residents still drive 30 minutes or more toward US 380 and other submarkets for upscale dining, curated retail, and lifestyle services. There is a shortage of chef-driven restaurants, design-forward home and interior shops, and boutique apparel and wellness brands that fit Celina’s income profile. Downtown and prime Preston Road sites are the natural landing spots for these concepts.

Specialized Professional Services and Executive Support Firms

Market Opportunity: A high-income, high-homeownership community plus ongoing large-scale development creates strong demand for wealth management, tax and estate planning, commercial real estate law, and business advisory services. New anchors and healthcare investments also bring in executives and professionals who prefer local, high-touch support.

Gap: Many affluent households and growing businesses still rely on firms in Plano, Frisco, or Dallas for complex legal, financial, and HR work. Locally based fiduciary wealth advisors, boutique law and consulting practices that understand Celina’s zoning, platting, and capital stack, and specialized HR and recruiting firms tailored to healthcare and large-format retail would fill a missing layer in the ecosystem.

Advanced, Tech-Enabled Residential and Property Services

Market Opportunity: Thousands of new, high-spec homes are being added each year, owned by busy households who value reliability and convenience. That is ideal terrain for subscription-style, tech-enabled residential services that handle maintenance, improvements, and smart-home features on an ongoing basis.

Gap: Conventional landscaping, pool, and handyman services exist, but there is still limited penetration of integrated offerings that combine scheduling apps, preventative maintenance plans, smart-home integration, and bundled property services tailored to Celina’s newer housing stock. The city’s own strategic planning documents reference smart city and connectivity goals, which aligns with residents who are comfortable adopting technology in their homes as well.

Takeaway: Celina’s next growth chapter will be defined less by new rooftops and more by who builds around them. Entrepreneurs who can deliver premium experiences, specialized advice, and technology-enabled services will be well positioned to plug into a resident base that values time, convenience, and quality more than sheer price.

Closing Insight

Celina has mastered the high-growth balancing act by proactively issuing $602 million in debt for necessary infrastructure, thereby turning rapid residential expansion into a validated, fiscally sound growth engine affirmed by a Positive S&P outlook.

If you’re benchmarking Celina, the key actionable strategy is the successful linkage between leveraging extreme residential affluence to accelerate commercial catch-up, focusing municipal resources on preemptive utility capacity, and utilizing targeted placemaking initiatives to transform a commuting suburb into a self-sustaining regional destination.

Social highlights….

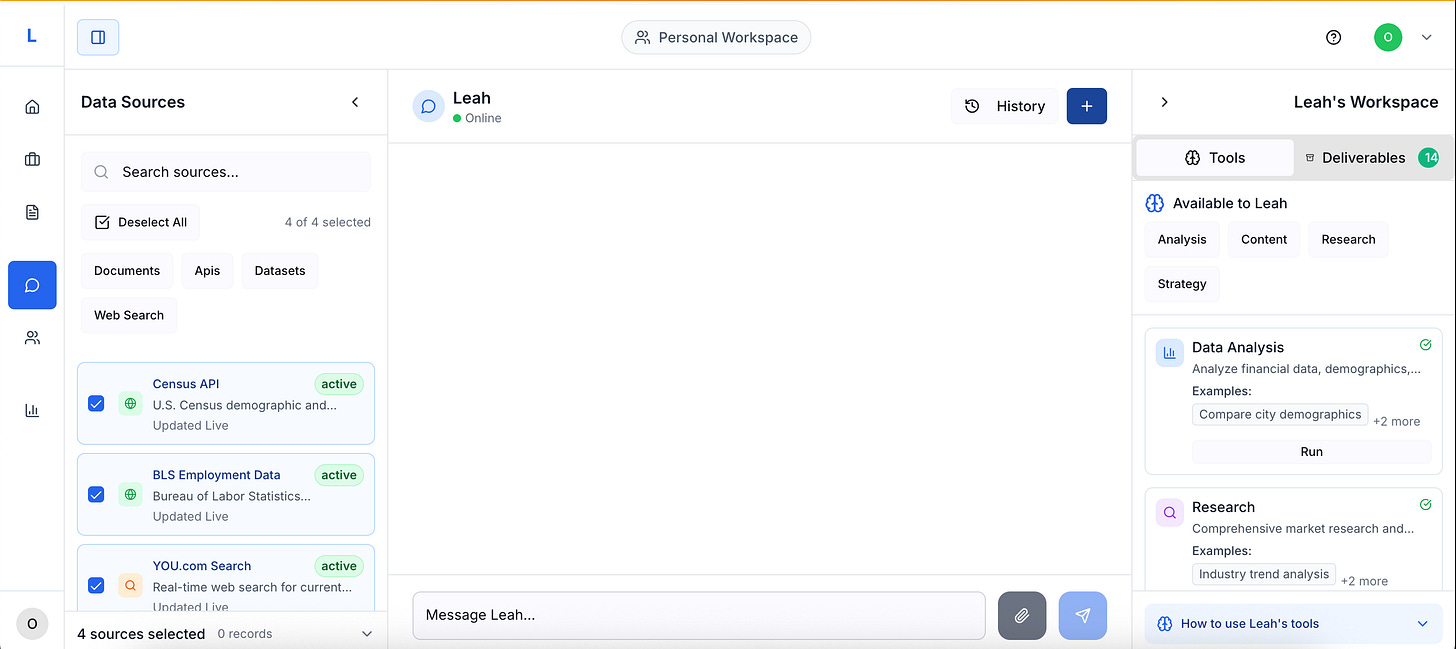

This week’s Sponsor… LEIP - ai powered workspace for EDOs

LEIP is an ai powered workspace built for Economic Development Organizations.

Let LEIP take care of the busy work and free up your REAL team.

Next Town: Corsicana, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Whenever you’re ready, EDO leaders…

Get a clear, operator-level plan to win better projects, defend your budget, and prove impact. → Book a free 30-minute strategy call