Solvency, Debt, and the AI Power Play in | Corsicana, Texas

Corsicana is trying to turn a 1 GW power advantage into an AI backbone while climbing out of an S&P downgrade and a tax hike needed just to keep core services funded.

EDO Power Law #2: Residents and Employers Are Owners

Treat locals and existing companies like the core asset, not an audience.

Upgrade to Texas Street All Access | $50/month and, in addition to this weekly brief, access…

Texas Street Trends, a premium monthly deep-dive covering the biggest economic, infrastructure, and industry shifts in Texas. If you’re trying to see early signals, spot risks before they hit Council, or stay ahead of competing cities, this is for you.

Subscriber-only playbooks, templates, and charts you can plug straight into your next pitch, briefing, or strategy session.

Texas Street Connect, a private community for Texas EDO leaders and local decision makers. A place to share what’s working, compare notes, ask questions, and get clarity fast. [Launching January 1st, 2026]

You’re no longer doing this alone.

All-Access gives you statewide intelligence and a network of operators who are in the trenches with you.

$50/month. Cancel anytime.

The first 30 founding members will help shape the community from day one.

Last week’s EDO Roundup…

Texas just locked in $1.3B to finish the broadband map (Nov 20)

Texas’ BEAD plan finally got the federal thumbs up, which means about $1.3B is now aimed at bringing real high speed internet to roughly 243,000 unserved or underserved locations across the state. If you’ve got gaps around your industrial parks, business districts, or training centers, this is the moment to line those maps up and figure out where you can ride this wave.Texas State is backing a $70M+ hotel at the edge of campus (Nov 24)

Texas State’s regents approved a $70–75M upper upscale hotel in San Marcos right by downtown, with the university itself kicking in a $45M construction loan and the city and county layering on 380/381 incentives. It brings 200+ jobs with an $18/hour wage floor and basically turns university land into a long term revenue and placemaking play.Ector County is turning 438 acres into an AI power campus (Nov 25)

Outside Odessa, Texas Critical Data Centers has quietly assembled 438 acres for a multi phase, multi gigawatt AI/HPC campus, with Phase 1 targeted for 2026. They are already in power interconnection and civil planning, positioning this site as part of the broader Texas AI load story that ties gas, future nuclear, and GPUs together in one place.Bonham’s Powder Creek Ranch will add 3,000+ homes using a PID (Nov 25)

Bonham rolled out Powder Creek Ranch, a 400 acre master planned community that will bring about 3,000 homes plus future retail and office over seven phases, with Phase 1 already moving. The key detail for EDO brains is that they set up a Public Improvement District, so roads, utilities, and amenities are paid back by the project itself instead of blowing up the general fund.Dallas is using a 380 deal to unlock “Rivulet” in University Hills (Nov 25)

In southern Dallas, the city is backing the first phase of the University Hills redevelopment called Rivulet, where about $47.2M of horizontal infrastructure will support roughly 300 single family and 200 multifamily units. Dallas is offering up to $23.5M in Chapter 380 grants, reimbursing infra costs as milestones are hit, which is a solid example of using incentives to front load neighborhood scale basics.AST SpaceMobile is doubling down on Midland for satellite manufacturing (Nov 28)

AST SpaceMobile is adding another facility in Midland as part of a two state expansion that brings its manufacturing footprint to around 500,000 square feet and 1,800+ employees, most of them in West Texas. It is a nice proof point that you can turn early wins in space/advanced manufacturing into a true cluster if you keep stacking sites and talent in one region.Buc-ee’s locked in new travel centers in San Marcos and Boerne (Nov 28)

Buc-ee’s confirmed a $47.2M, ~74,700 sq ft store in San Marcos with around 175 full time jobs, plus a somewhat smaller 54,000 sq ft location in Boerne under a renegotiated deal. The Boerne agreement is interesting because it caps pumps, bakes in 26 EV chargers, and shifts a lot of road and sewer work into a structured reimbursement setup so the city still gets better design and infrastructure control.Tyson is cutting 1,761 jobs at its Amarillo beef plant (Nov 28)

On the tougher side of the ledger, Tyson is laying off 1,761 workers in Amarillo by January 20, 2026 as it consolidates operations into one full capacity shift. For any Panhandle or rural EDO watching this, it is the kind of event that hits not just workers but also suppliers, housing, and local retail, so it is a textbook scenario for rapid response and reskilling coordination.

Solvency, Debt, and the AI Power Play in Corsicana

Issue 20

B.L.U.F. Corsicana is running a high-risk, high-reward play. It is using its I-45 logistics base and a rare, nearly 1 gigawatt power platform to pivot from a traditional distribution hub into a potential North Texas AI and high-performance computing node, anchored by Riot Platforms’ evaluation of converting 600 MW of remaining capacity at its Corsicana site to AI/HPC uses.

At the same time, the city is absorbing a downgrade of its general obligation rating to A+ due to repeated operating deficits and has moved to raise its effective property tax rate from $0.4526 to $0.4948 per $100 to stabilize the budget and keep funding core services and industrial-support infrastructure.

Corsicana has spent decades as a logistics and manufacturing workhorse on I-45 between Dallas and Houston. The next chapter is different. This brief looks at Corsicana through two lenses: treating utility capacity as the primary incentive in the AI infrastructure wave, and testing whether its fiscal position is strong enough to support that pivot without breaking the balance sheet.

City Financial Profile

Corsicana is operating under real budget stress, but with a manageable current-year debt load and clear moves to restore solvency. The city is using a higher property tax rate to close operating gaps while still reserving room to issue future debt for industrial-support projects.

Credit downgrade flags structural imbalance

S&P Global Ratings lowered Corsicana’s long-term rating on its general obligation bonds and certificates of obligation to A+ from AA-, citing “budgetary distress” and three consecutive operating deficits, with another deficit expected in the current fiscal year.FY2025 tax strategy leans on a higher rate

The City Council authorized the process to establish a FY2025 tax rate of $0.4948 per $100, explicitly higher than the prior $0.4526 rate, and explicitly calculated to raise more money for Maintenance and Operations (M&O) than the previous year.Sales tax is lagging internal expectations

In the Q3 2025 Quarterly Financial Report, city sales tax revenue is about $7.2 million year-to-date against a full-year budget of $10 million, running behind target and limiting the city’s ability to lean on growth in this category to close operating gaps.Public safety spending is rising ahead of growth

In FY2026 budget discussions, the proposed Police Department Services budget increases from $7.51 million to $7.98 million, and Fire Department funding rises from $6.82 million to $7.29 million, reflecting higher operating costs and staffing needs as the city prepares for more growth and more complex industrial risks.Debt service is modest relative to capacity

The “Current Year” Debt Obligations schedule for FY2025 shows Fund 411 general obligation debt service (bonds plus lease purchases) totaling about $3.55 million, within a broader $7.26 million current-year debt service across all funds. This leaves meaningful room to issue new GO or CO debt if the city tightens operating performance.

Takeaway: Corsicana is not fiscally broken, but it is operating on a tighter margin than its prior rating implied. The city is consciously trading political comfort on tax rates for restored operating stability, while keeping debt at a level that still allows future bond issuance for utility and infrastructure projects that support large industrial and AI/HPC users.

Economic Drivers

Corsicana’s current economy runs on logistics and manufacturing, but its most important emerging driver is the potential repositioning of a massive power asset into AI and high-performance computing.

I-45 logistics as the core engine

Corsicana sits at the crossroads of I-45, US 287, and SH 31, giving it direct access to Dallas–Fort Worth, Houston, and Waco. The city is home to more than 60 industries, including a cluster of major distribution and manufacturing employers such as Home Depot’s distribution center, Kohl’s distribution and call center, Guardian Industries, Firestone Building Products, True Value’s distribution center, and others.Established industrial confidence and reinvestment

RPM International’s Tremco Construction Products Group acquired a 178,000 square-foot chemical manufacturing facility on 120 acres in Corsicana, with plans to expand and retain more than 80 employees, signaling long-term confidence in the local workforce and industrial platform.AI/HPC as a step-change in tax base quality

Riot Platforms has halted a planned Phase II Bitcoin mining expansion and is formally evaluating using the remaining 600 MW of power capacity at its Corsicana site for AI and high-performance computing, within a facility entitled for up to 1 GW of total capacity.

The taxable value and wage profile of AI/HPC infrastructure are typically far higher and more specialized than traditional warehousing or low-density crypto mining, which positions Corsicana for a structural upgrade in its industrial tax base if the pivot proceeds.Public infrastructure used to unlock private investment

The Corsicana EDC previously secured a $500,000 U.S. Economic Development Administration grant for sanitary sewer main and lift station improvements at an industrial park along I-45, a project expected to leverage about $7 million in private distribution and warehouse investment.

Takeaway: The current economy is anchored by dependable logistics and manufacturing jobs, but the real upside lies in the AI/HPC pivot and continued industrial site development. Corsicana is already using targeted public infrastructure dollars to de-risk private projects, which is exactly the pattern that will matter if a 600 MW HPC campus and its vendors begin to scale around I-45.

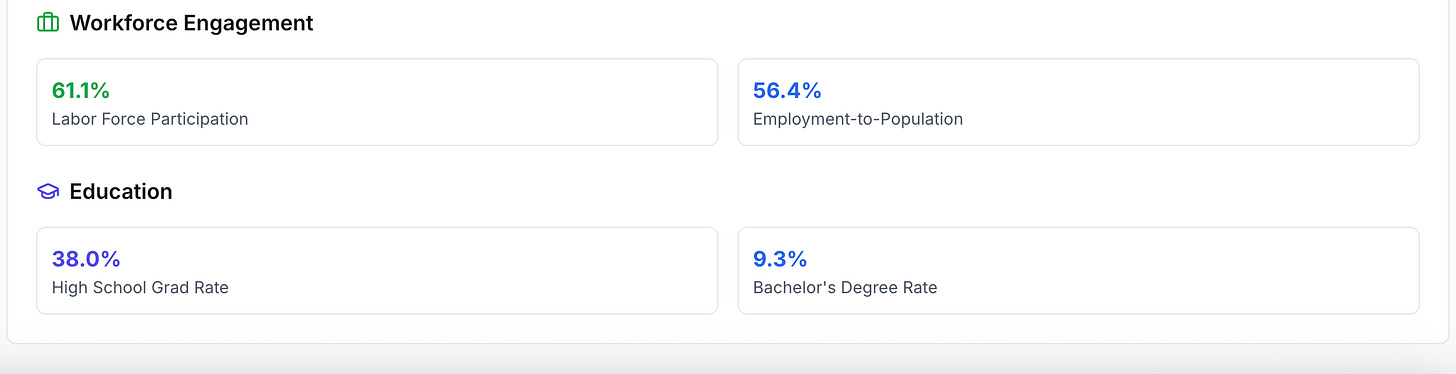

Business Climate and Growth Indicators

Corsicana’s development pattern shows a clear split: fast-moving support for industrial corridors and more curated, higher-friction processes in its historic downtown. Both sides matter for long-term competitiveness.

Zoning framework ready for higher residential density

The zoning map includes a full ladder of residential districts, including Multiple-family Residential-1 (MF-1) and Multiple-family Residential-2 (MF-2), giving the city the legal ability to absorb higher-density housing if developers respond.Downtown operates under a curated overlay

The Historic Downtown District is mapped as an overlay of roughly 25 blocks near the city center. Projects there are subject to specific design guidelines that support historic character and more intensive retail and mixed-use activity.Landmark Commission enforces quality and adds friction

For properties in the Downtown Overlay District, any change to a building or site requires a pre-application meeting with Main Street staff and approval by the Landmark Commission before a Certificate of Appropriateness is issued. The city recommends allowing up to 15 days from pre-application to approval.Capital plan focused on function and resilience

The city’s Major Projects list includes utility and street reconstructions on corridors such as North 24th Street and West 14th Avenue, targeting aging infrastructure in established neighborhoods and industrial routes.

At the state level, TxDOT reports about $32.9 million in active construction in Navarro County as of Summer Q3 2025, including embankment stabilization on I-45 and multiple bridge replacements, directly improving reliability for freight users.Residential activity appears to be trailing expectations

The Q3 2025 Quarterly Financial Report shows Builder Registration fee revenue below budget, with about $14,756 collected versus a $23,000 budget, suggesting that new residential construction is not keeping pace with the city’s own planning assumptions.

Takeaway: On the regulatory side, Corsicana has already built the zoning and downtown oversight structures that many growing towns still lack. The weak point is not policy, it is execution: capital projects are shoring up key corridors, but private residential investment is not yet matching the scale of industrial opportunity, which could become a constraint on workforce growth.

Opportunity Gaps

Corsicana’s combination of a 1 GW power platform, industrial growth, and slower-than-expected housing delivery creates three clear market gaps for operators and investors.

Specialized High-Performance Computing (HPC) Technical Services

Market Opportunity: Build or expand local firms that provide high-density data center support, including specialized electrical, cooling, fire suppression, and controls services built around 24/7 uptime expectations for AI and HPC users.

The Need / Gap: Riot’s evaluation of converting 600 MW of remaining capacity at the Corsicana facility from Bitcoin mining to AI/HPC will move the site from a lower-risk, lower-density use to one that demands rapid-response, highly specialized technical vendors. Relying solely on DFW-based firms increases response times and operational risk for a potential 1 GW campus.

High-Density, Attainable Workforce Housing

Market Opportunity: Acquire or entitle sites in MF-1 or MF-2 districts and deliver multi-family projects at price points aligned with logistics, public safety, and entry-level technical wages.

The Need / Gap: Industrial expansions, public safety hiring, and potential AI/HPC growth will bring more workers, yet Builder Registration fee revenue is trailing budget, signaling that actual housing production is not keeping up with anticipated demand. If that gap persists, Corsicana risks losing its cost advantage and making recruitment harder for both industrial employers and the city itself.

Destination Retail and Curated Hospitality Downtown

Market Opportunity: Aggregate and reposition multiple storefronts in the Downtown Overlay District into a cluster of higher-quality dining, boutique retail, and entertainment that serves both residents and higher-income industrial and AI/HPC talent.

The Need / Gap: The city is missing sales tax targets, which implies spending is leaking to larger markets. Downtown offers lower entry costs and targeted incentives, including access to the Texas Historic Tax Credit program and local Main Street tools, while the Landmark Commission process provides a built-in quality filter that can support a more intentional “destination” district.

Takeaway: If the AI/HPC pivot proceeds, Corsicana’s bottlenecks will not be power or road capacity, they will be specialized technical vendors, attainable workforce housing, and a downtown that matches the expectations of higher-wage talent. Entrepreneurs who move early in these three areas will be building directly into the city’s next chapter rather than chasing today’s conditions.

Closing Insight

Corsicana is a useful benchmark for EDO directors who are being asked to “catch the AI wave” with limited fiscal room. It shows what happens when a city pairs an outsized utility asset and industrial corridor with a more fragile operating budget and a mid-tier credit rating.

The real strategic question is not whether Corsicana can attract AI/HPC interest, it already has. The question is whether leadership can translate the FY2025 tax reset and targeted capital plan into enough housing, workforce training, and vendor depth to hold that value locally over time. For EDO teams watching from similar towns, Corsicana is a reminder that utility access is a powerful draw, but solvency, site readiness, and community capacity still decide who actually wins the long game.

Social highlights….

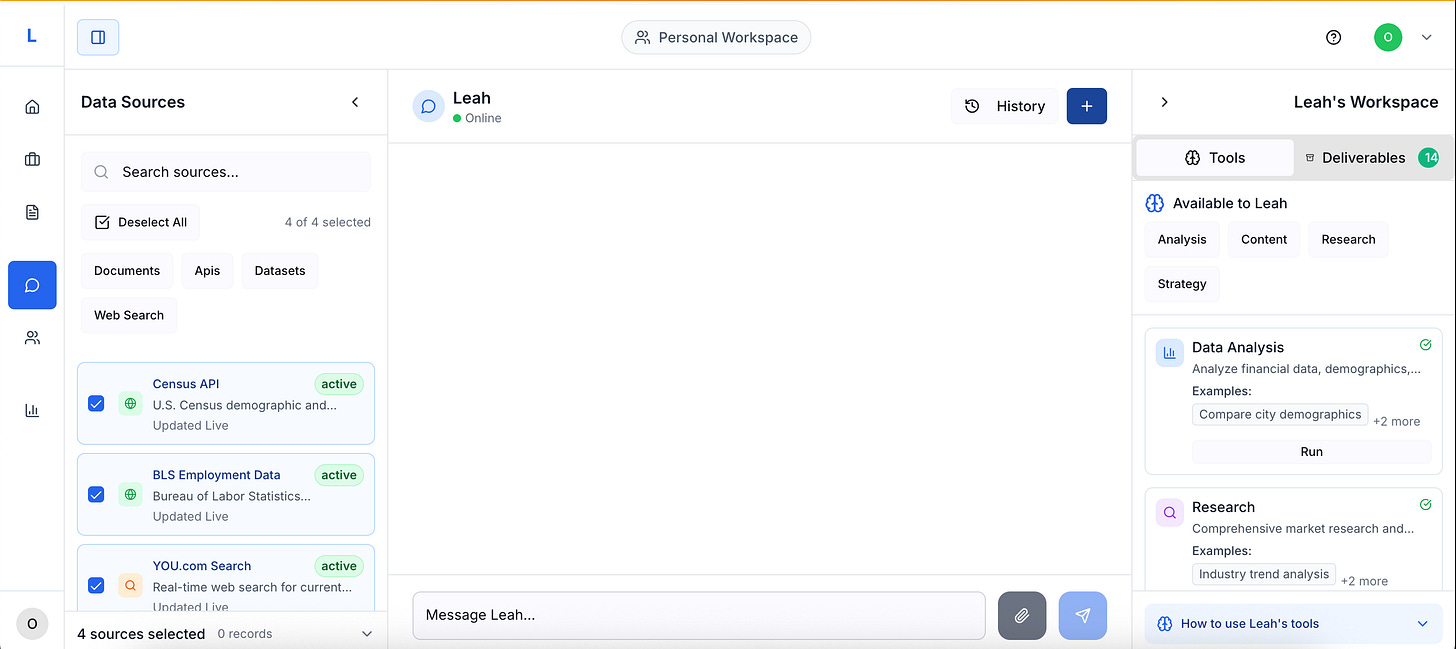

This week’s Sponsor… LEIP - ai powered workspace for EDOs

LEIP is an ai powered workspace built for Economic Development Organizations.

Let LEIP take care of the busy work and free up your REAL team.

Next Town: Breckenridge, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Whenever you’re ready, EDO leaders…

Strategy Session w/ me; focused 30-minute meeting designed to quickly align on goals and priorities. You can expect crisp insights, well-defined next steps, and an actionable plan to move your strategy forward in a concise, decision-driven format.