Kingsville’s $500M Bet on the Future

How a South Texas anchor city is aligning military, university, and carbon capture growth.

“Fiscal strength is the floor, but capturing the upside takes speed.”

This week’s Sponsor… LEIP [AI Team for EODs]

Small teams, big impact.

I’m preaching to the choir… the workload never stops: budgets, reports, site selectors, council meetings, etc…

LEIP is your built-in AI team: running the research, writing the reports, and building the decks, so your people can focus on relationships and decisions.

👉 Level the playing field for your community, and join the waitlist.

Last week news clips…

Dell is putting $25 million into expanding its headquarters in Round Rock. They’re planning upgrades through 2026 and tying new jobs to veterans, enterprise zone residents, and disadvantaged communities. Looks like they’re also pursuing the Texas Enterprise Zone designation.

Down in Laredo, Killam Development is committing about $40.7 million over 10 years to breathe new life into downtown. The plan mixes historic restoration with food, art, and retail, backed by Chapter 380 incentives.

A $400 million fund was announced at the NADBank Summit in San Antonio to help border communities like Laredo with water conservation and reuse projects. A wastewater feasibility study should be wrapped up by 2026, opening the door for new infrastructure pilots.

In San Antonio, Brooks leaders just shifted $9.5 million to redesign the I-37 & SW Military Drive interchange. The total project is $41.9 million, and they’re pushing for AAMPO funds to close a gap. The redesign will turn it into a diverging diamond, good news for traffic flow and future business access.

And over in Sugar Land, the city pitched in $2.5 million to become an “Official Supporter” of the 2026 FIFA World Cup. With Houston hosting matches, Sugar Land’s hoping to ride the wave of global visibility and regional tourism spending.

Kingsville’s $500M Bet on the Future

Issue: 08

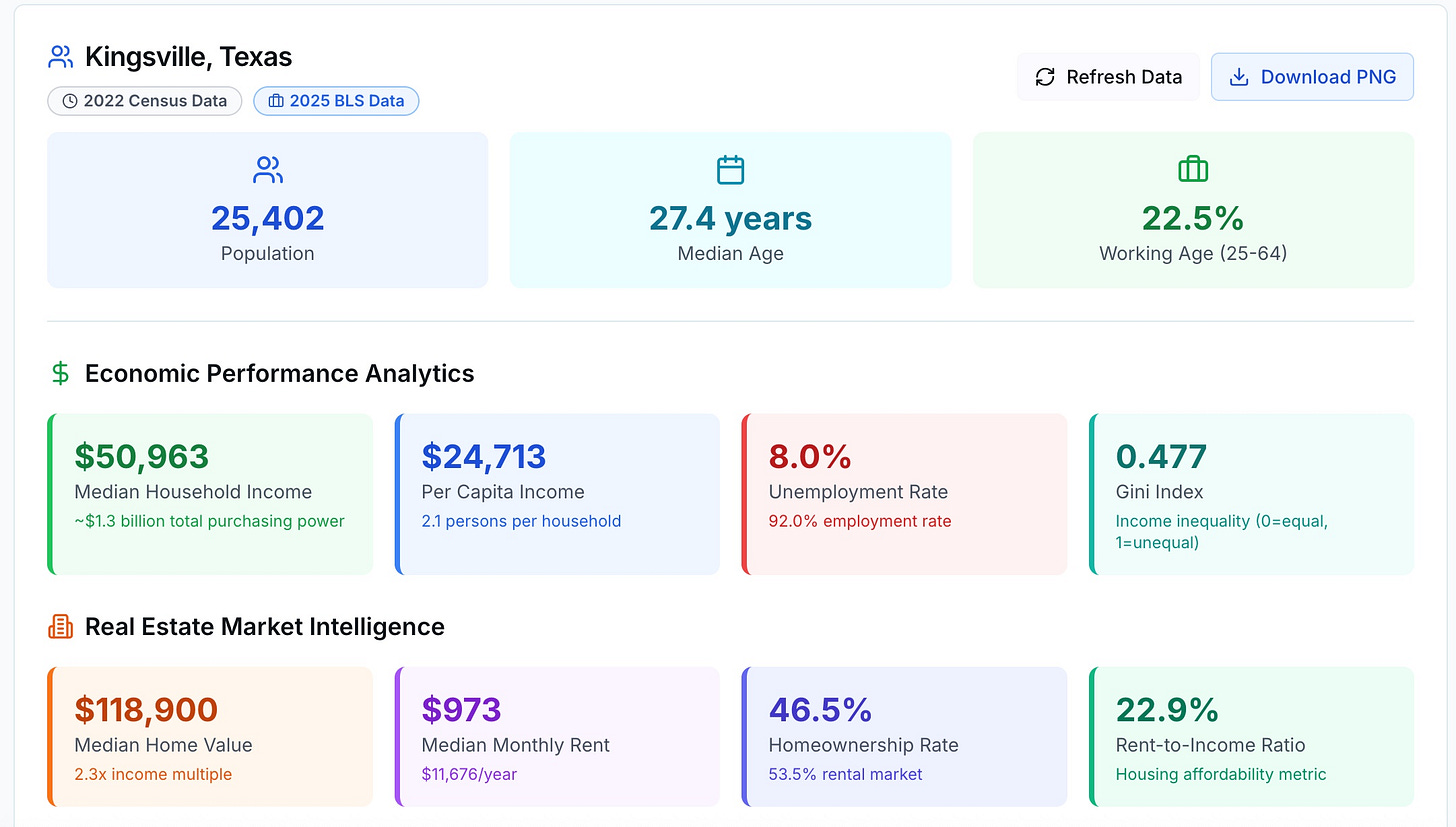

B.L.U.F.: Kingsville presents a compelling development case grounded in institutional stability and positioned for industrial transformation. The city manages a $116.18 million FY2025 budget, up 15.78% year over year, while maintaining diversified revenues that extend well beyond property taxes. Anchors like Naval Air Station Kingsville and Texas A&M University-Kingsville provide recession-resistant stability with combined impacts exceeding $600 million annually. Meanwhile, the proposed $500 million 1PointFive carbon capture facility represents the largest new industrial investment in decades.

Challenges remain around infrastructure capacity and housing supply, but $50 million in ongoing upgrades and new residential development signal active planning. For economic development directors, Kingsville illustrates how mid-tier Texas cities can leverage institutional anchors while capturing next-generation industrial opportunities.

This analysis examines Kingsville through the lens of fiscal management, economic diversification, and strategic positioning within South Texas. The city’s trajectory shows how institutional resilience can align with industrial reinvestment to reshape regional competitiveness.

City Financial Profile

Kingsville demonstrates disciplined fiscal management, with stable reserves and diversified revenue streams balancing one of the state’s heavier local tax burdens.

FY2025 budget: $116.18M, up 15.78% YoY, reflecting expanded capital projects and operations (City of Kingsville Budget, 2024.)

Property tax rate: Raised slightly to $0.77/$100 valuation; when combined with county and school district rates, effective burdens approach $3.00/$100 (Kleberg CAD, 2024.

Debt service: $1.94M in FY2025, indicating conservative leveraging (City of Kingsville Budget, 2024)

Capital investments: $50M in infrastructure upgrades, including the Caesar Avenue widening and construction of Fire Station #3 (City CIP, 2024)

Diversified revenues: Utilities generate $12.15M; sales tax allocations rose double digits in 2023; hotel occupancy tax receipts also edged upward (Texas Comptroller, 2023)

Reserves: General Fund ratio at 26.59% and Utility Fund at 26.06%, both above required thresholds (City of Kingsville Budget, 2024)

Takeaway: Kingsville’s fiscal position is solid, balancing a high overall tax burden with healthy reserves, non-tax revenues, and cautious debt practices that support major infrastructure initiatives.

Economic Drivers

Kingsville’s economy rests on durable institutional anchors while preparing for transformative industrial growth.

Naval Air Station Kingsville: Roughly 1,800 military and civilian personnel with a regional economic impact above $120M (Texas Comptroller, 2021)

Texas A&M University-Kingsville: Generates $491.9M in regional impact and 8,844 jobs, with new programs like the Javelina Skilled Trades Academy expanding workforce capacity (TAMUS Impact Report, 2023)

King Ranch: Historic 825,000-acre operation that draws ~30,000 visitors annually while partnering on land use for carbon capture initiatives (King Ranch, 2023)

Small business backbone: Roughly 1,000 firms employ the majority of Kingsville’s ~13,000 workers, generating steady sales tax growth (U.S. Census ACS 2022; Texas Comptroller, 2023)

Emerging industry: Occidental subsidiary 1PointFive has proposed a $500M direct air capture hub that would create ~2,500 construction and 120 permanent jobs, positioning Kingsville as a South Texas carbon management center (1PointFive press release, 2023) - In May 2025, Occidental (parent of 1PointFive) announced a potential joint venture with XRG (ADNOC’s global investment arm), exploring a private investment of up to $500 million in the DAC facility.

Takeaway: Kingsville blends institutional resilience with forward-looking industry shifts, leveraging its anchors while capturing high-value opportunities in carbon capture technology.

Business Climate and Growth Indicators

Kingsville maintains a transparent regulatory environment with targeted incentives and infrastructure expansion aligned to growth corridors.

Regulatory framework: Adopted 2024 International Building Code suite; permitting streamlined with standardized fees (City of Kingsville, 2024)

Development process: Weekly pre-development meetings improve early coordination; zoning changes managed with advisory reviews and public hearings (City P&Z, 2024)

Strategic location: Along the planned I-69 corridor, 40 miles from the Port of Corpus Christi, with Union Pacific rail access (TxDOT, 2024)

Incentive tools: Maintains FTZ designation plus HUBZone eligibility, supporting competitive positioning (U.S. Census HUBZone Maps, 2024)

Infrastructure capacity: $50M upgrades underway to expand utility and roadway capacity, including the Caesar Avenue widening (City CIP, 2024)

Housing pipeline: The Somerset subdivision, 234 homes, begins construction in late 2024, marking the city’s largest recent residential project (City Planning Agendas, 2024)

Takeaway: With clear permitting, strategic incentives, and active infrastructure upgrades, Kingsville demonstrates both regulatory predictability and market readiness, supporting incoming industrial and residential investment.

Opportunity Gaps

Three distinct opportunity areas align with Kingsville’s fiscal strength, anchors, and industrial transition.

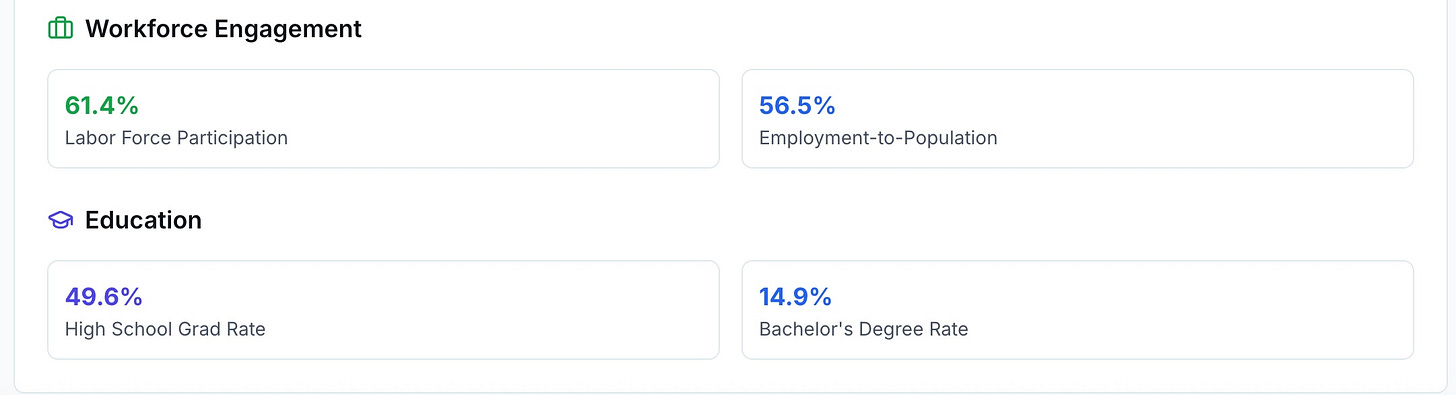

Skilled Trades Training and Certification

Market Opportunity: Workforce demand from 1PointFive and local infrastructure projects exceeds current training pipeline.

Gap: TAMUK’s new academy is a start, but regional need for NCCER certification and industrial maintenance training remains unmet.

Executive and Short-Term Housing

Market Opportunity: Rising demand from NAS Kingsville staff, TAMUK faculty, and industrial project managers.

Gap: Current housing pipeline focuses on family units, with little supply of furnished corporate apartments or executive rentals.

Specialized Industrial Services

Market Opportunity: Carbon capture facilities require ongoing support in monitoring, fabrication, and process controls.

Gap: Most specialized services are sourced from Corpus Christi or Houston, leaving local suppliers absent.

Takeaway: These gaps highlight near-term opportunities for private investors and entrepreneurs to support the industrial build-out while addressing workforce and housing needs.

Closing Insight

Kingsville is at an inflection point, where its identity as a military-and-university town converges with industrial reinvention. The city’s ability to align fiscal discipline with workforce development and infrastructure delivery will define whether it captures the full value of carbon capture investment.

Looking for source links…

You’ll now find them in this linked Google Folder.

Over time, I’ll also drop in other context interview notes, photos from site visits, etc.

But, for now, it’s just the source list. If there’s anything else you’d find useful in that folder, let me know in the comments.

Social highlights…

Next Town: Paris, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.