Lampasas is at an inflection point | $7M invested. Still mostly empty.

An under-the-radar city with infrastructure money, Fort Hood demand, and untapped service gaps.

“The goal isn’t growth at all costs, it’s growth that pays dividends back into the community.”

This week’s Sponsor… LEIP [Learn more]

Small EDO teams are stretched thin.

LEIP is your built-in AI staff for research, reports, and pitch decks, giving you the scale of a larger team without the cost.

I’m inviting 10 EDO leaders to help shape LEIP. 1 spot is filled, only 9 left.

👉 Reply “Interested” to this email to grab yours today, and I’ll buy you coffee for a week.

Issue: 07

B.L.U.F.: Lampasas is positioning itself as a strategic value play in Central Texas, leveraging a 20.24% property tax revenue increase to fund major infrastructure upgrades while keeping a competitive fiscal stance. The city faces infrastructure capacity constraints but offers strong opportunities in underserved retail, professional services, and Fort Hood–linked supply chains.

Lampasas sits at an inflection point.

Strategically located between Austin (70 miles) and Fort Hood (25 miles), the city is managing steady growth with fiscal discipline. It represents controlled expansion, using targeted infrastructure investment and business park repositioning to capture Texas Triangle spillover while preserving its small-town operational advantages.

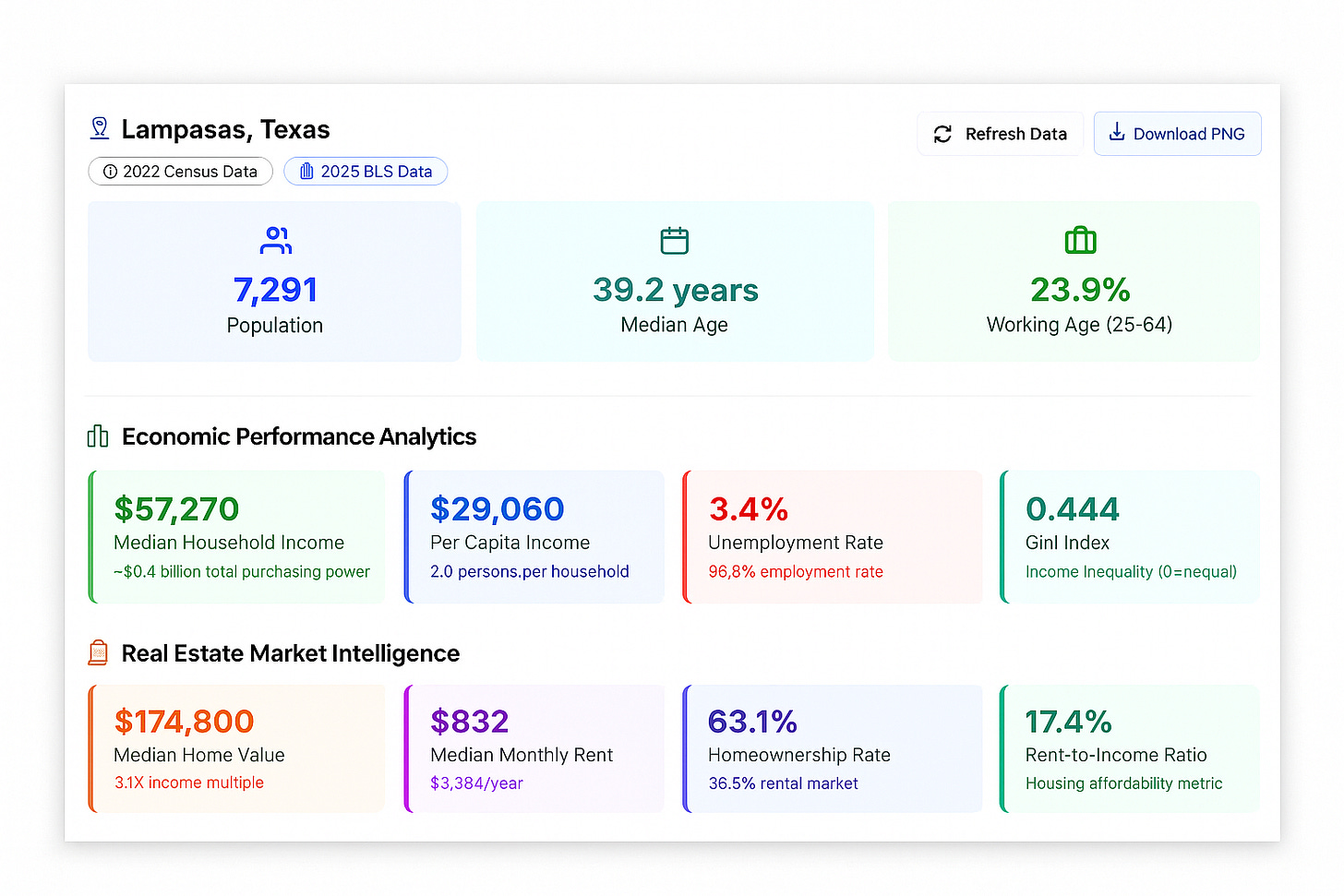

City Financial Profile

Lampasas is operating from a position of fiscal strength, funding ambitious capital programs while maintaining low debt.

FY2025 budget: $14.27M (up 8.9% from $13.1M in FY2024).

Revenue model: Property tax rate raised from $0.304888 to $0.34 per $100, generating a 20.24% increase ($386,554) with only $44,426 from new construction.

Debt management: $1.38M total obligations; $1.45M debt service fund with payoff scheduled 2025–2030.

Capital investment: $640K for streets/capital outlay, $138K in police vehicles, $65K in fire equipment.

Fiscal benchmarking: Property tax rate of $0.34 remains competitive vs. Kyle ($0.417) and other peers, while Lampasas carries a lower debt burden.

Takeaway: Lampasas is funding infrastructure catch-up through rising property values, not over-leveraging, showing measured fiscal expansion.

Economic Drivers

The economy is anchored by manufacturing and by its proximity to Fort Hood, but lacks diversification in primary jobs.

Manufacturing base: Major employers include Oil States Industries (energy systems), Windsor Foods/Ajinomoto (frozen foods), and American Greetings.

Employment distribution: Top sectors are Accommodation/Food Services (602 jobs), Construction (485), and Manufacturing (397), with limited professional services.

Geographic advantage: Highway convergence (US 183/190/281) offers alternatives to the I-35 corridor, 25 miles from Fort Hood’s regional impact.

Business park underutilization: 144-acre park (46 acres ready) remains mostly vacant after $7M investment; partial divestiture under consideration.

Takeaway: Lampasas has a stable base but a narrow mix. Heavy reliance on manufacturing creates resilience but limits growth momentum.

Business Climate and Growth Indicators

Infrastructure upgrades are catalyzing activity, though development volumes lag behind regional peers.

Infrastructure catalysts: $2.5M+ US 281 reconstruction (2024–2026) plus TxDOT relief route feasibility stud.

Development momentum: New Fourth Street projects, Irvin Steel Construction (12,000 sq ft), and Day One Family Fitness ($1.25M investment) show private confidence.

Regulatory environment: Streamlined permitting; online applications but manual inspection scheduling.

Zoning: Balance of historic downtown preservation with highway-frontage commercial corridors.

Takeaway: Infrastructure investment is creating momentum, but permitting and commercial activity remain modest; leaving room for accelerated attraction strategies.

Opportunity Gaps

Three opportunities for Lampasas’s based on the cities economic profile:

Healthcare Services Hub

With only 250 healthcare jobs serving 22,000+ county residents, Lampasas lacks specialized medical services. Median income of $63,173 and aging demographics support higher-value healthcare demand.Professional Business Services

Construction employs 485 workers, yet gaps exist in engineering, architecture, and project management. Manufacturers like Oil States and Ajinomoto also require technical services often sourced externally.Tourism & Recreation Infrastructure

Spring Park and the historic downtown attract visitors but lack supporting retail/dining. Recent LCRA $25K trail grant and Forward Lampasas engagement points to coordinated tourism development.

Closing Statement

Lampasas illustrates disciplined growth, leveraging property tax base expansion for infrastructure without overextending debt. With transportation upgrades, business park repositioning, and systematic property recovery underway, the city is positioned to capture Texas Triangle spillover.

The next challenge is execution: turning infrastructure and Fort Hood proximity into diversified job creation beyond its manufacturing-heavy base.

Looking for source links…

You’ll now find them in this linked Google Folder.

Over time, I’ll also drop in other context interview notes, photos from site visits, etc.

But, for now, it’s just the source list. If there’s anything else you’d find useful in that folder, let me know in the comments.

3 posts that caught my attention this week…

Next Town: Kingsville, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with Texas Street on LinkedIn and Facebook.