Leander, TX: $1B Boom; Austin's Fastest-Growing Suburb Goes All-In

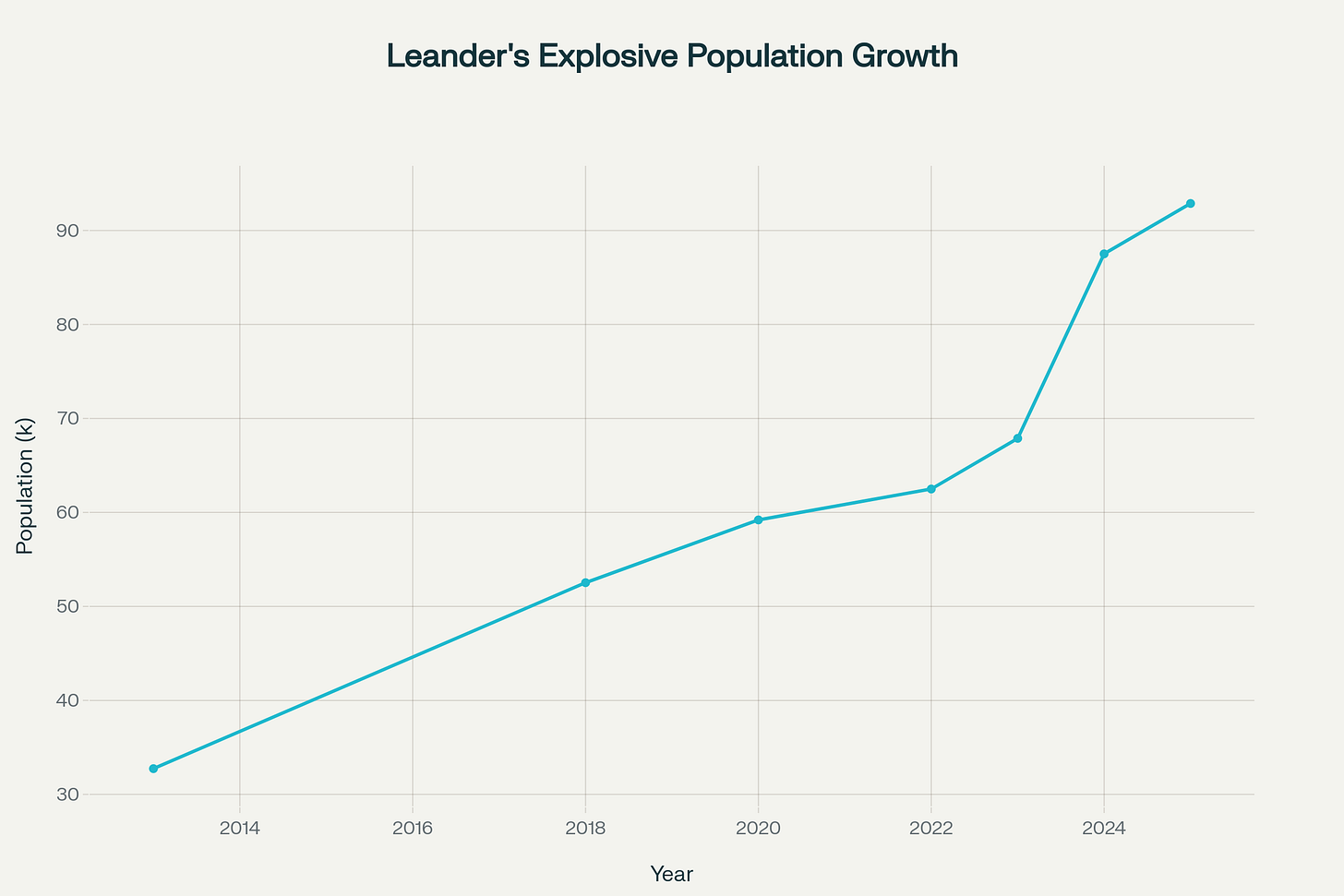

Why every EDC director should be studying this 183% growth story, and the zoning fight that could change everything.

Issue: 03

Street BLUF: Leander is riding a wave of explosive economic growth as Austin’s fastest-growing suburb, with a $338M FY25 budget, 183% population increase since 2013, and over $1B in active mixed-use and industrial investment. The city’s evolution from commuter enclave to a regional economic hub is defined by Northline, tech/industrial expansion, and aggressive infrastructure plays. Watch the September 2025 Council vote on Leander Springs as a key bellwether.

Sponsor: Bell Chime Capital - Selling Your Texas Business? Skip the lengthy sales process. Local buyers who understand your market and value what you've built. Get your free business valuation today → Visit BellchimeCapital.com

Leander's transformation from quiet suburban outpost to regional economic powerhouse offers a compelling case study in strategic growth management.

Twenty miles north of Austin, this Williamson County city has posted a 183% population surge since 2013 and over $1 billion in active development projects while maintaining fiscal discipline and development quality that sets the standard for suburban growth. Though recent development denials and institutional delays highlight critical inflection points ahead, Leander's strategic decisions, infrastructure investments, and business-friendly policy framework demonstrate how to successfully harness explosive demographic trends.

This analysis examines how Leander leveraged its Austin proximity to build a billion-dollar development pipeline, revealing the growth management strategies that enabled its bedroom-to-economic-center transition and the institutional challenges that could define its next expansion phase.

City Financial Profile

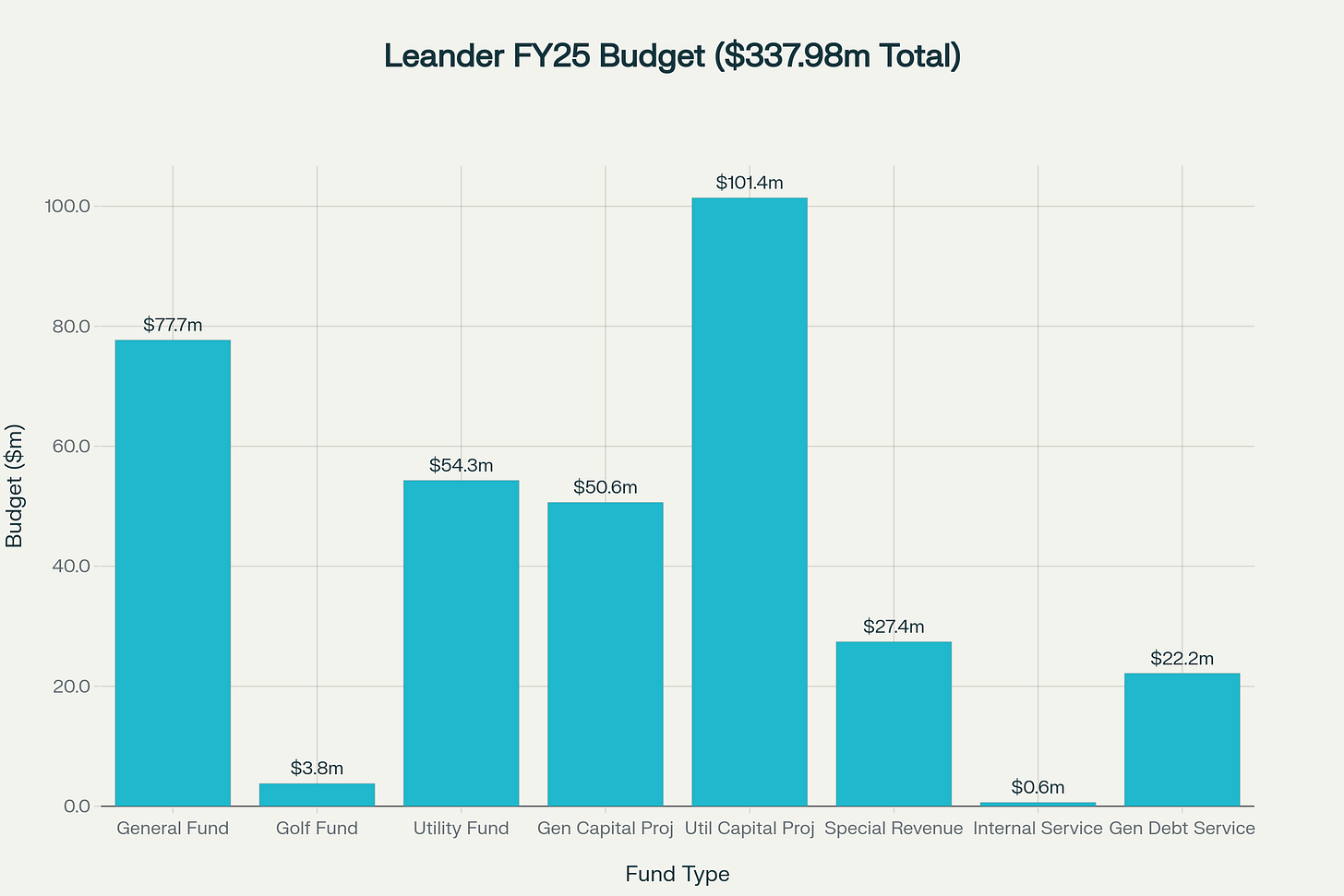

Leander's financial position reflects rapid growth and strategic investment in infrastructure.

The FY 2025 budget totals $337.98 million, representing a 6.6% increase from FY 2024's $317.03 million. This growth trajectory demonstrates the city's expanding fiscal capacity driven by robust property tax base expansion.

Revenue sources are primarily property tax-driven, with the tax rate held flat at $0.417282 per $100 valuation for FY 2025. However, this represents a 3.5% effective increase due to property value growth. Property tax revenue will increase by $5.6 million (10.5%), with 74.5% of this increase coming from new property additions to the tax roll - a clear indicator of sustained development activity.

Debt profile shows disciplined management with a declining debt service tax rate of $0.143678 per $100 valuation, down 7% from the prior year. Total debt service requirements for 2024 include $22.16 million across various bond series, including recent 2024 refinancing that demonstrates proactive debt management. Moody's Aa1 and S&P's AA ratings reflect strong creditworthiness based on growing tax base, above-average income levels, and robust financial management.

Capital investments are substantial, with $152.03 million allocated across General Capital Projects ($50.6M) and Utility Capital Projects ($101.4M) in FY 2025. Key expenditures include infrastructure for growth areas, the $200,000 traffic signal at Palmera Ridge and Ronald Reagan Boulevard, and technology investments totaling $2.3 million.

Fiscal risks appear limited given the strong growth trajectory, though rapid expansion requires careful infrastructure timing. The city's ability to maintain flat tax rates while expanding services demonstrates effective management of growth-related challenges. Reserve levels and bond capacity position Leander well for continued strategic investments.

Takeaway: Leander’s fiscal stance is strong; the city is effectively leveraging tax base growth for major capital initiatives while holding the line on tax rates.

Economic Drivers

Leander's economic transformation over the past decade reflects a deliberate shift from suburban residential growth to diversified commercial and industrial development.

The employer landscape centers on education and emerging commercial sectors.

Leander ISD serves as the largest local employer with 42,511 students enrolled across 48 campuses as of 2024-25, employing over 6,000 staff members.

Major retail anchors are locally and regionally focused rather than dominated by national big-box chains. H-E-B operates two locations while Randalls anchors Crystal Falls Town Center, providing full-service grocery with pharmacy services. These retail centers reflect Leander's emphasis on community-serving commercial development over regional destination retail.

Business formation trends show accelerating commercial and industrial permitting. More details below.

Takeaway: Leander has successfully diversified from residential-only growth to a balanced mix of education, healthcare, retail, and industrial sectors, positioning itself as a regional economic center rather than just an Austin suburb.

Business Climate & Growth Indicators

Leander's business climate combines proactive, growth-oriented policies with streamlined processes to facilitate quality development while maintaining competitive advantages for business location and expansion.

Regulatory Framework: The Development Hub online platform provides efficient permitting with 3-20 business day review timelines based on project complexity. The City actively updates development rules and maintains 2021 IRC building code standards that help keep development costs competitive.

Zoning Strategy: The Transit-Oriented Development (TOD) district at downtown Northline uses form-based codes to foster walkable, higher-density growth around the rail station and the Austin Community College campus. Traditional zoning elsewhere provides development flexibility for standard commercial and light industrial projects.

Business Incentives: Case-by-case packages include Chapter 380 economic development agreements and Chapter 312 property tax abatements, focusing on quality job creation and targeted sectors. The Economic Development Committee serves as a conduit between the city, business, and resident stakeholders.

Development Momentum: Accelerating commercial and industrial projects with major tech parks, industrial developments, and mixed-use centers are in the pipeline. Projects benefit from coordinated infrastructure investments and major public funding for developments like Northline.

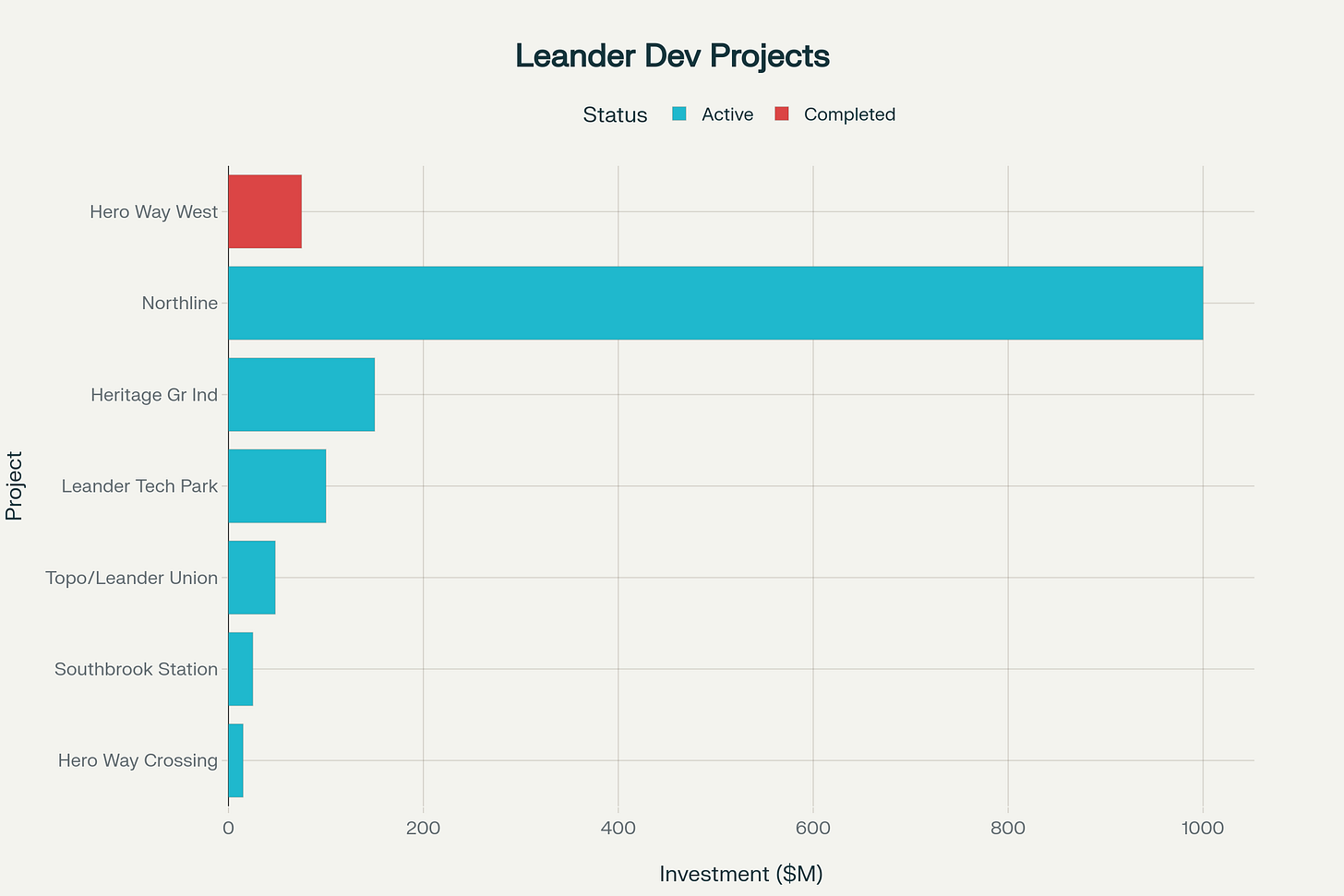

Major development projects represent over $1B in private investment across multiple sectors.

Northline: 116-acre mixed-use downtown district with 5 million square feet of projected development, including retail, office, residential, hotel, and civic uses. Broke ground in 2020 with full buildout expected by 2031.

Leander Springs: a 4-acre crystalline lagoon, 275–450 hotel rooms, a 20,000 sq ft conference center, and ~1,200 apartments faces uncertainty after the Planning & Zoning Commission's 4-1 denial vote in July 2025. City Council decision in September 2025 could override the denial; if denied, development limited to 35,000 square feet of commercial space.

Industrial Expansion: St. John Properties' 50-acre Leander Tech Park delivers the city's first Class A office development. In addition,

EastGroup Properties plans 600,000 square feet at Heritage Grove.

Freehill Development completed Hero Way West with 227,200 square feet of industrial space.

Other notable callouts include:

Southbrook Station - Multi-building retail development at 4615 US 183, opening in April 2025 with tenants like Cava, Einstein Bagels, Firehouse Subs, etc.

Hero Way Crossing - 15,000 SF retail center featuring Layne's Chicken Fingers, Jersey Mike's, Sports Clips, Advance Auto, Sherwin-Williams, plus 42,000 SF medical office behind it

Shops at Hero Way - $12.8M, 23,566 SF retail center (completed 2023)

Key Takeaway: Leander has created a business-friendly environment that attracts over $1 billion in private investment, but faces critical inflection points where regulatory decisions and institutional commitments will determine whether current momentum sustains long-term economic diversification.

Opportunity Gaps

Leander's rapid population growth to 92,871 residents with a high median household income ($132,148) has created significant service gaps where demand outpaces supply, presenting substantial opportunities for entrepreneurs and business investors.

Primary Market Gaps

Entertainment & Recreation: Despite strong demographics, Leander lacks family entertainment venues like movie theaters, bowling alleys, mini golf, and family recreation centers.

Upscale Dining & Craft Beverage: Only 105 restaurants serve 90,000+ residents, with limited upscale casual dining and craft breweries. The Old Town Master Plan's $15M infrastructure investment and city restaurant incentive programs support new establishments.

Healthcare & Wellness Services: Gaps include specialized medical practices, mental health services, physical therapy, and wellness centers.

Home Services: High homeownership rates and aging housing stock create demand for handyman services, drought-smart landscaping (driven by Phase 2 water restrictions), house cleaning, and move-in/move-out services. Current providers are primarily sole proprietors with limited capacity.

Key Takeaway: Leander's explosive growth has created a temporary mismatch between sophisticated consumer expectations and available services, offering substantial opportunities for quality operators who can deliver professional, branded experiences to an underserved and growing affluent market.

Closing Statement

Leander’s trajectory is no accident.

It’s the product of long-range planning, smart capital deployment, and a city leadership team that’s proven comfortable making bold moves at just the right moments.

But the path forward is anything but autopilot.

As billion-dollar bets like Northline mature, and as flashpoint projects like Leander Springs hang in the balance… the city’s next chapter will be shaped by how well it aligns new growth with the realities on the ground: infrastructure capacity, community needs, and the kind of identity Leander wants to preserve.

PSA: Source links and details are moving.

Starting with this issue, I’m moving all source references out of the main article. You’ll now find them in this linked Google Folder, which keeps the briefings focused while giving you a place to dig deeper when needed.

Over time, I’ll also drop in other context interview notes, photos from site visits, etc. But, for now, it’s just the source list. If there’s anything else you’d find useful in that folder, let me know in the comments.

Next Town: Bertram, Texas

Have a great week! See you next Monday,

Omegadson