This City Isn’t a Hidden Gem. It Needs a Balance Sheet. | Llano, Texas

Higher taxes, shrinking reserves. Time to turn Llano’s assets into cash flow.

“Don’t chase charm. Build cash flow.”

Add TS TRENDS to your Monthly Routine.

For a fraction of a $5,000 big-firm report, get a statewide tech deep dive on the first Wednesday of every month across AI, compute, energy, logistics, biotech, and more so you can spot projects early, de-risk decisions, and move first.

Last week’s EDO Roundup…

Texas Fed says the Texas economy is easing off the gas, not stalling – November 4 Dallas Fed’s latest Texas Economic Indicators read shows growth slowing: manufacturing is soft, services are mixed, and wage growth is modest, but it’s not a doom story. It’s more like, “We’re still growing, just not sprinting,” which is useful context when you’re explaining to your board why the quality of projects now matters more than raw count.

Tesla now hiring for its $200M Brookshire Megafactory – November 9

Tesla’s started posting jobs for the Megafactory west of Houston, with a plan to invest about $200M and ramp up to 1,500 jobs by 2028. The kicker for EDO brains: this sits on top of county and city tax abatements approved earlier this year, so it’s a live example of how a well-structured deal actually turns into hiring and payroll.NRG’s $936M Cedar Bayou gas plant gets the JETI stamp – November 12

NRG is adding a 721 MW unit at its Cedar Bayou site in Chambers County, nearly a billion dollars in new dispatchable generation backed by a Texas Energy Fund loan and JETI designation. This is a “put it in your slide deck” example that you can point to when a project asks if Texas is actually adding firm power or just talking about it.Chevron picks the Permian for its first AI power plant – November 12

Chevron is planning a 2.5 GW off-grid natural gas plant in West Texas specifically to feed AI/data center loads, with an option to double it later. The play is “put the power next to the gas, not the city,” which is a big hint for rural and West Texas EDOs about how to package sites for compute-heavy users.FTI bringing 200+ skilled manufacturing jobs to El Paso – November 12

Faith Technologies Incorporated is building a 500,000-square-foot facility on 48 acres in Pellicano Industrial Park, tied to modular electrical and energy equipment, with more than 200 skilled manufacturing jobs on deck. El Paso County backed it with a Chapter 381 agreement that can rebate tens of millions over time, which is a nice real-world blueprint for pairing advanced manufacturing with county-level tools.Texarkana College wins $805K to train 335 manufacturing workers – November 13

Texarkana College landed just over $805,000 from the Skills Development Fund to upskill 335 workers for Graphic Packaging International. It’s a classic “college + employer + state” triangle, and it’s the kind of story you can literally reference when you tell a prospect, “Yes, we can bring SDF dollars to custom-build your training pipeline.”Google announces $40B Texas data center and infrastructure push – November 14

Google and the Governor rolled out a $40B plan for Texas: new data centers in Haskell and Armstrong counties, expansions in DFW/Midlothian, plus energy and workforce pieces bundled in. For pitches, this is your new “Texas is a serious AI/compute hub” anchor slide, and it also quietly highlights the smaller markets Google thinks can actually support big power + land needs.

This City Isn’t a Hidden Gem. It Needs a Balance Sheet…

Issue 18

B.L.U.F. Llano is a small Hill Country seat with a stable but shrinking General Fund, higher property tax rates, and no clear capital pipeline. The FY2025 General Fund budget is about 5.82 million, down 2.3 percent from the prior year, even as Llano County’s population continues to grow. The city is closing its gap by raising the tax rate to 0.53870 per 100 dollars of value, essentially at the voter approval level, and by drawing down reserves rather than expanding its revenue base.

Ending General Fund balance is budgeted to fall about 19 percent in FY2025 and unrestricted balance about 38 percent, while there is no multi-year capital plan for water, broadband, or downtown reinvestment in the adopted budget. Llano’s economy leans on services, retirees, and tourism, with city-level employment concentrated in health care, retail, and construction, and county-level data showing an older, non-participating population and service-heavy industry mix.

The opportunity is clear: Llano has brand equity in its river, granite history, and wildflower corridors, but it has not yet built the lodging, riverfront experiences, or workforce housing that would turn weekend traffic into weekday revenue.

City Financial Profile

Llano’s fiscal posture is conservative and resource-constrained, with a budget that balances today by using yesterday’s savings.

General Fund is shrinking in real terms. The FY2025 General Fund budget totals about 5.82 million in operating revenues, down 2.3 percent from the FY2024 amended budget of roughly 5.96 million.

This means the city is budgeting a smaller operating footprint even as costs rise and the broader county adds residents.

Tax rate is at the voter-approval line, with modest new value. The FY2025 budget materials show a proposed property tax rate of 0.53870 per 100 dollars of valuation, compared with a no-new-revenue rate around 0.48777 and a voter-approval rate of 0.53876. The council adopted the 0.53870 rate by ordinance for tax year 2025.

Budget disclosures note that the citywide levy will rise by about 61,866 dollars, of which roughly 17,848 dollars comes from new construction, with the rest from higher taxes on existing value. In other words, most of the tax gain is coming from rate, not growth.

Reserves are being drawn down to balance operations. Estimated ending General Fund balance is budgeted to fall from about 2.53 million in FY2024 projected actuals to about 2.04 million in FY2025, a drop of about 491,000 dollars or 19 percent.

After backing out the city’s restricted reserve target, estimated unrestricted General Fund balance drops from roughly 1.12 million to about 697,000 dollars, a decrease of roughly 38 percent. The city is using savings to cover a portion of its operating and capital needs.

Capital purchases are pared back while streets see catch-up spending. In the General Fund summary, capital purchases are budgeted at about 305,000 dollars in FY2024 and zero in FY2025, while the Streets department line rises from about 655,000 dollars to about 1.29 million.

This points to a near-term focus on road maintenance and basic equipment rather than new system capacity. There is no standalone, multi-year capital improvements plan attached to the FY2025 budget document.

Debt profile appears manageable, but without a clear growth story. The FY2025 budget references existing general obligation bonds and notes, including 2017 GO bonds and a Golf Pro Shop note, and sets a separate debt service tax rate within the total 0.53870 rate.

However, the budget does not pair that debt schedule with a visible slate of new large capital projects, which limits Llano’s ability to tell a forward-leaning infrastructure story to residents or investors.

Economic development funding is meaningful but not transformational.

The Llano Economic Development Corporation (LEDC), funded by a dedicated portion of local sales tax, budgets about 473,000 dollars in revenues for FY2025–26 and roughly 397,000 dollars in expenditures, leaving a projected fund balance under 100,000 dollars.That scale supports studies, small facility upgrades, and business support programs, but not major recruitment deals or site development without outside partners.

Takeaway: Llano’s finances are stable but tight. The city holds a voter-approval-level tax rate, shrinking General Fund revenues, and a planned drawdown of unrestricted reserves of nearly 40 percent in one year. There is more evidence of catch-up maintenance than of a capital pipeline aimed at growth. Fiscal management is cautious, but it is oriented around preserving service levels rather than investing ahead of demand.

Economic Drivers

Llano’s economy rests on a service-heavy local base, an older population, and regional tourism that it has not fully captured.

City jobs concentrate in health care, retail, and construction. As of 2023, the city of Llano has about 1,630 employed residents. The largest industries by employment are Health Care and Social Assistance (about 245 workers), Retail Trade (about 195), and Construction (about 178).

This reflects a local economy built around essential services, small trades, and local shopping rather than large employers or export-oriented industry.

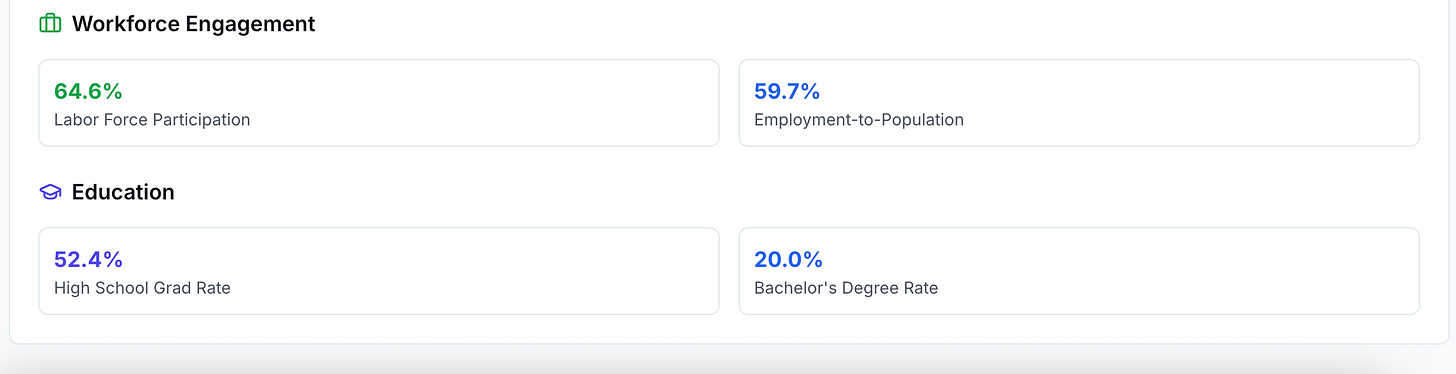

County employment is small and service-weighted. Llano County’s economic profile shows about 8,200 employed residents in 2022, with high non-participation in the labor force and service occupations dominating its occupation clusters, including hospitality and back-office services.

Between 2012 and 2022, county population rose from roughly 19,500 to about 22,540, an increase of about 3,000 residents, driven mainly by domestic migration.

Demographics skew older and less attached to the labor force. Headlight’s profile notes that 52.8 percent of adults in Llano County are not in the labor force, with a large share of residents over 55 and relatively fewer working-age adults compared to state and national norms.

That pattern fits a county that attracts retirees and second-home owners, which supports property values and some service jobs but limits the depth of the local labor pool.

Tourism and outdoor recreation are real but under-organized. State travel materials and regional articles highlight Llano’s surroundings as one of the strongest wildflower and bluebonnet viewing areas in Texas, calling out highways near Llano and the Willow City Loop as signature drives. Enchanted Rock State Natural Area, the Highland Lakes, and the Llano River all sit within day-trip distance, and Texas outdoor recreation as a whole contributes more than 55 billion dollars in economic impact statewide.

Yet Llano’s lodging and outfitter footprint remains relatively limited compared to more built-out Hill Country destinations like Fredericksburg or New Braunfels.

Public sector and schools are key anchors. Llano ISD serves about 1,942 students across four campuses, with a student to teacher ratio of roughly 12.7 to 1, making the district one of the largest and most stable employers in the county.

County government, city government, and local health care providers add to this base, providing steady but largely non-growth jobs.

Limited evidence of industrial or tech anchors. City-level industry data does not list manufacturing, logistics, or information technology among the top employment sectors, and there are no widely reported large corporate sitings or industrial park announcements in recent years.

That does not mean there are no small manufacturers, but it confirms that Llano is not yet on the radar for large industrial or tech projects.

Takeaway: Llano’s economic base is more “service town with retirees and tourists” than “diversified small city.” The jobs are real, but they are fragmented and heavily tied to households and visitors rather than export industries. Without a stronger capture strategy for tourism and a deeper employment base, the city will remain vulnerable to swings in travel behavior and retirement inflows.

Business Climate and Growth Indicators

Llano’s business climate is friendly and flexible, but the city has not yet built the playbook or infrastructure that signal a proactive, pro-growth stance.

Zoning and land use are conventional, not strategic. Public documents show standard small-city zoning and subdivision regulations, with the courthouse square protected and commercial corridors along Highways 16 and 29.

There is no prominent, recent comprehensive plan or corridor-specific strategy that ties these zones to clear economic development goals, such as mixed-use riverfront, highway hospitality nodes, or employment districts.

Permitting appears manual and resource-limited. Llano uses typical small-city permitting processes for building, floodplain, and subdivision review, administered by a small staff. Applications are paper or PDF driven and routed internally, with no widely advertised fast-track program or digital one-stop portal.

For small projects this is workable, but for larger investors it can translate into uncertainty on timing and expectations.

Infrastructure investments are focused on maintenance. The FY2025 budget nearly doubles General Fund Streets spending while zeroing out capital purchases, and it maintains basic water and wastewater operations without outlining major capacity expansions.

The city participates in regional water planning through the Lower Colorado Region K, but there is no clear public narrative on Llano’s specific long-term water or broadband projects.

Incentive toolkit is basic. Llano participates in the standard set of Texas tools, including potential use of Chapter 380 agreements and Type B EDC funding, but there are minimal customized local incentives, fast-track development agreements, or targeted workforce partnerships with nearby higher education institutions.

Takeaway: Llano is not an anti-growth city, but it is not yet a high-signal pro-growth city either. The basic tools are present, and staff appear approachable, but there is no clear, public playbook for investors that combines zoning, incentives, infrastructure, and timelines into a coherent offer. For now, Llano competes on charm and cost, not on speed or strategic clarity.

Opportunity Gaps

Given Llano’s fiscal constraints, demographic profile, and regional position, three practical, near-term market gaps stand out.

Mid-Tier Lodging and Extended-Stay Hospitality

Market Opportunity Llano sits on widely marketed wildflower and Hill Country driving routes, within easy reach of Enchanted Rock, the Highland Lakes, and Fredericksburg, and has a recognized tourism brand around the Llano River and bluebonnets. At the same time, the city’s lodging inventory is limited compared to better known Hill Country destinations. A 60 to 80 room mid-tier hotel or extended-stay property near the main highway corridors could capture overnight demand from wildflower tourists, Enchanted Rock visitors, youth sports and school events, and state highway traffic that currently overnights elsewhere.

The Need / Gap The fiscal data show a city that needs new revenue sources more than higher tax rates. Hotel occupancy tax and related sales taxes are among the most direct ways to convert visitor volume into general revenue without further burdening local homeowners. A 60 room hotel at 65 percent occupancy and a 140 dollar average daily rate would generate roughly 2 million dollars in annual room revenue, creating meaningful new tax receipts and spin-off restaurant and retail activity even before any conference or group business is layered in.

Experiential Retail and River-Centered Outfitting

Market Opportunity Llano’s downtown square sits a short walk from the Llano River, with public parks, river access points, and a growing calendar of festivals such as art, music, and seasonal events. Regionally, Hill Country towns have proved that guided outdoor experiences, rentals, and small-format experiential retail can generate high-margin revenue from visitors who are already in the area. Llano is well positioned to host a flagship adventure and culture operator that bundles kayak and paddle rentals, guided fishing, geology or stargazing tours, and a retail storefront that sells local art, gear, and granite or llanite themed merchandise.

The Need / Gap Current economic data show that many Llano residents work in food service, arts and entertainment, and related occupations, but there is no single, dominant outfitter or experiential hub on the river. Visitors often treat Llano as a lunch stop on the way to or from Enchanted Rock or Fredericksburg instead of a place to spend a full day. Turning the riverfront into an activity anchor would lengthen stays, increase per-visitor spending, and support downtown tenancy. City leadership can help by clarifying riverfront zoning, improving wayfinding between the square and the parks, and using LEDC funds to de-risk a first-mover operator.

Workforce Housing and Small-Scale Build-to-Rent

Market Opportunity Llano’s median household income is about $47,183, with a homeownership rate of about 57 percent and a median property value just over $200,000, all well below Austin metro levels. Llano ISD serves nearly 2,000 students and has grown its enrollment in recent years, while health care and local government remain core employers. That combination points to steady demand from teachers, nurses, first responders, and service workers who need quality rentals in the 1,200 to 1,500 dollar per month range. A 40 to 60 unit workforce-oriented build-to-rent neighborhood or small apartment community could fill this need and stabilize the local labor market.

The Need / Gap Public data and on-the-ground observation suggest that most of Llano’s housing stock is single-family or small, scattered rentals, with very limited traditional multifamily inventory. As the county adds residents and the school district and hospital hire staff, those workers either compete with retirees for limited houses or commute from Marble Falls, Burnet, or other nearby towns. A modest, well designed workforce housing project would reduce commute burdens, support employer recruitment, and expand the tax base without stressing infrastructure the way large-lot exurban development can. City tools here include zoning clarity, infrastructure cost-sharing, and targeted incentives for projects that reserve a meaningful share of units at attainable workforce rents.

Opportunity Takeaway: These three plays are grounded in the data and in Llano’s actual position on the map. Lodging turns drive-through traffic into tax revenue, experiential riverfront retail turns festivals and day-trips into full weekend stays, and workforce housing turns regional growth into a deeper local labor pool. Together, they give Llano a practical next chapter that fits its size, brand, and balance sheet.

Closing Insight

Llano’s numbers tell a simple story: the city is solvent but under-invested, sitting in the path of growth without yet choosing how to shape it. The budget is being balanced with a higher tax rate and a thinner cushion, not with new taxable value or big productivity gains.

For Llano, the task is not to chase every opportunity, but to pick a short list of visible bets that align with Llano’s assets and fiscal reality. A hotel on the highway, an outfitter on the river, and a workforce project near schools and services are the kinds of moves that can be explained in one slide and financed in today’s market. If Llano can match its heritage identity with a sharper, infrastructure-backed growth story, it can move from being a pretty stop on the way to somewhere else to being a small city where people choose to stay.

Source links…

Available here: this linked Google Folder.

Social highlights….

This week’s Sponsor… LEIP - ai powered workspace for EDOs

LEIP is an ai powered workspace built for Economic Development Organizations.

Let LEIP take care of the busy work and free up your REAL team.

Next Town: Celina, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Whenever you’re ready, here’s how I can help…

Advisory for EDO Leaders: I help cities apply private-sector discipline to public goals and turn strategy into execution. → Book a free 30-minute strategy call