Mason’s Edge Isn’t Jobs, It’s Nights | Mason, Texas

With ~2,000 residents, 7 tasting rooms, and a $17.49M water project online, Mason’s growth lever is nights stayed, not jobs added.

Run the city with the financial clarity of a company. Lead the community with the heart of a neighbor. Owners (Residents) first. Transparency always. Solvency before spectacle.

Go Premium - Upgrade and add Texas Street Trends

Upgrade Now; the first report: Wednesday, November 5th, 2025

Every first Wednesday of the month, you’ll get:

A monthly deep dive on the technologies reshaping Texas: AI, compute, energy, logistics, biotech, and more.

Data-backed visuals that make complex trends easy to explain

City-level insights you can use in meetings, pitches, and planning

Full access to the Trends archive as it grows

Timely Coverage: delivered once a month with clarity you can act on.

Last week’s EDO Roundup…

Modine adding 1,000+ jobs in Grand Prairie (Oct 14, 2025)

Big win for DFW industrial: Modine’s Airedale unit is standing up an advanced cooling-equipment plant with more than a thousand hires targeted by early 2026. Think mechatronics, assembly, and fast ramp.PepsiCo locks 1.1M-sq-ft “1NA Mixing Center” west of Houston (Oct 14, 2025)

Brookshire lands the region’s heftiest industrial lease of the year; filings also show a $5.3M office build-out dubbed “Project Otis.” Logistics gravity on I-10 keeps getting stronger.Meta to invest $1.5B in El Paso AI data center (Oct 15, 2025)

El Paso gets a hyperscale AI campus designed to scale toward 1-GW, ~100 long-term jobs and ~1,800 construction at peak; power, water, and speed will rule site picks like this.AstraZeneca’s $445M expansion doubles Lokelma output in Coppell (Oct 15, 2025)

Life-sciences capacity play: new lines, validation, and supporting infrastructure at the company’s only global Lokelma site, a signal for GMP-ready facilities around DFW.Texas to submit final BEAD plan: ~$1.3B in broadband grants (Oct 16, 2025)

The state’s BDO is moving its final proposal, unlocking last-mile builds through 2026; time to queue dig-once policies and fiber workforce cohorts with colleges.H-E-B opening $40M, 131k-sq-ft Rockwall store Oct 29 (Oct 16, 2025)

First H-E-B in town with BBQ, curbside, and pharmacy, expect a retail node effect and some sales-tax lift along I-30.Eden Green to close Cleburne facility; 100+ layoffs (Oct 16, 2025)

Vertical-farm operator winds down by Dec 13; good moment to redeploy maintenance/controls talent to food, biotech, or HVAC-heavy employers.Texas saw ~1,280 layoffs in two weeks, across sectors (Oct 17, 2025)

WARN filings stack up: semis, aviation services, logistics, healthcare; worth a quick employer roundtable to catch and keep experienced ops talent locally.

Mason’s Edge Isn’t Jobs, It’s Nights…

Issue 14

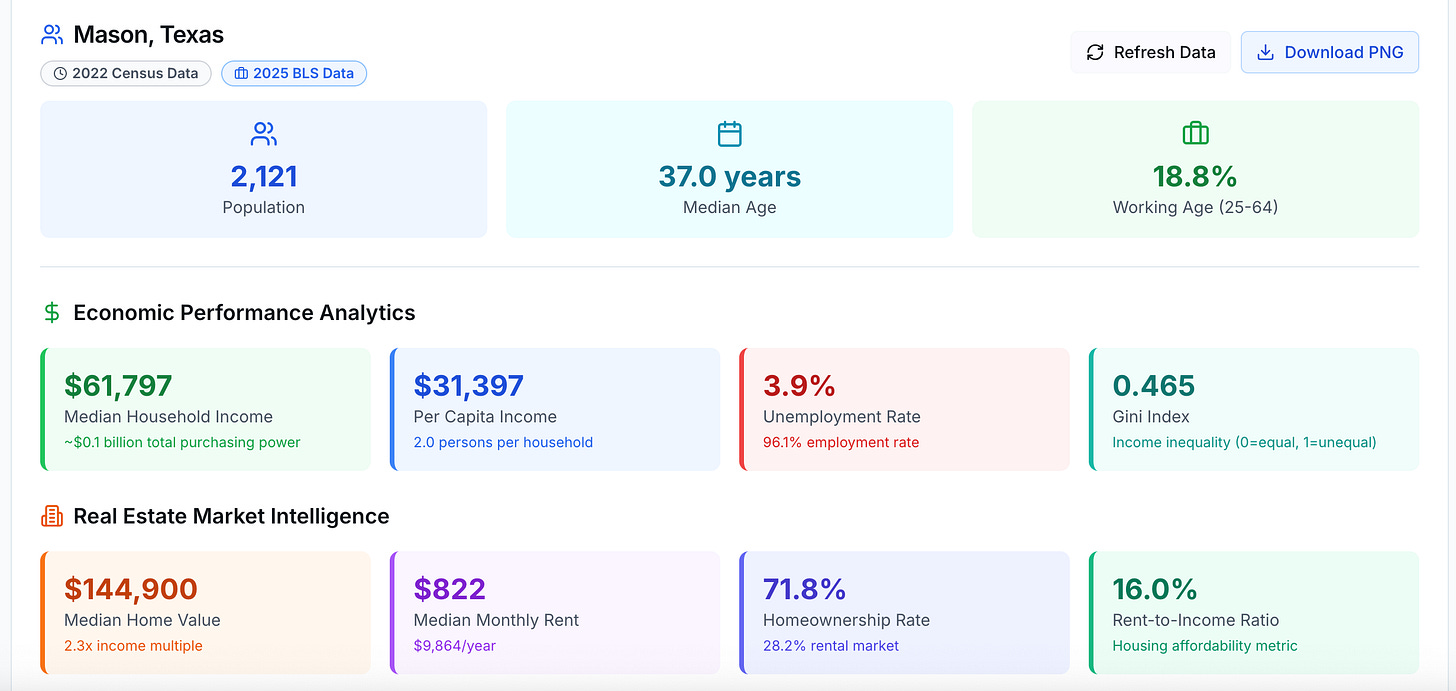

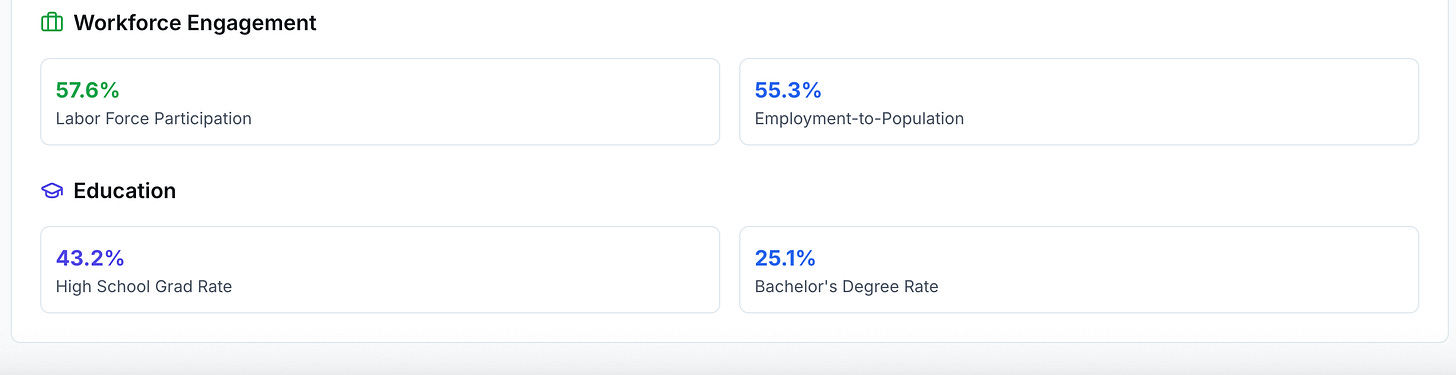

B.L.U.F. Mason is a 2,000-person Hill Country county seat that is turning wine tourism and heritage assets into its next chapter while the ranching base holds. The city just secured $17.49 million from the Texas Water Development Board to replace 56,000 feet of lines and add a 200,000-gallon tank, removing a core growth bottleneck.

City taxes remain low, but the revenue model is narrow, leaning on utilities and modest sales tax. Public schools and the county account for most of the local tax bill, not the city. The near-term opportunity is visitor conversion, getting day-trippers to stay overnight and spend across food, retail, and experiences.

Mason sits ~110 miles northwest of Austin, outside interstate corridors, with appeal built on rivers, ranches, and a compact historic square. This brief looks at fiscal footing, economic drivers, the business climate, and the concrete gaps entrepreneurs can fill.

City Financial Profile

Mason operates with lean city functions and conservative budgeting.

City property tax rate: $0.177152 per $100 for Tax Year 2024.

Other local rates: Mason County $0.642700, Mason ISD $1.108000 for 2024-25. On a combined basis, ISD is ~57%, county ~33%, city ~9% of the local levy.

Capital catalyst: TWDB approved $17.49M in DWSRF assistance in Sept. 2024 to replace ~56,000 linear feet of lines, loop the system, and build a 200,000-gallon ground storage tank, with an estimated $6.8M in lifetime savings vs traditional financing.

Takeaway: The water project is real capacity, not ribbon-cutting. It positions Mason to handle measured growth. The constraint is revenue diversity. Without more sales-tax-generating commerce, the city will rely on property values and utility rates, tools that move slowly and face political limits.

Economic Drivers

Three pillars keep Mason steady: working lands, tourism, and the public sector.

Agriculture and ranching: County data show a small, older, high-homeownership population with agriculture and education among top industries. Median household income is ~$68,750, and homeownership is ~76–80% by source.

Wine tourism: The Chamber lists seven wineries and tasting rooms tied to downtown activity and nearby vineyards. Statewide, Texas wine contributes >$24.39B in economic value per 2025 industry reporting. Mason captures a slice, but wine traffic is growing.

Nature and heritage: The Eckert James River Bat Cave is one of the nation’s large nurseries, with millions of bats seasonal to the preserve, and the 1928 Odeon Theater keeps the square active with films and concerts.

Population base: A small market that requires high capture of visitor spending to move the needle.

Takeaway: Mason has shifted from agriculture-only to agriculture plus wine-led tourism. The base is still narrow, but the assets are genuine and increasingly visible.

Business Climate and Growth Indicators

Mason is friendly to small operators, but deal flow is thin.

Regulatory posture: Straightforward permits and a clear fee schedule. County subdivision rules updated in 2022. No evidence of complex, unpredictable approvals.

Notable asset for sale: The historic Zesch Building on the square, ~7,200 sf split configuration, listed with active retail and restaurant uses, signals both opportunity and transition on the square. Lehmberg Realty

Infrastructure: The TWDB project resolves leaks and storage redundancy, a prerequisite for new lodging and food-service capacity. Wastewater capacity details were not published.

Takeaway: Low friction to start, limited space to scale. With water limits easing, demand is the swing factor. The next moves must turn weekend traffic into overnight spending.

Opportunity Gaps

Mason can win by converting day trips into two-night stays. Three immediate plays:

Overnight hospitality and experiential lodging

Market opportunity: Seven wineries, heritage square, river access, and bat cave evenings, but sparse inns and boutique options. Texas wine’s statewide impact is large, and evening nature draws favor overnights.

The need/gap: Day-trip behavior caps spend. A 12–30-key boutique hotel, upscale B&B cluster, or glamping near the Llano River would capture lodging, dinner, brunch, and retail. The water upgrade supports new rooms.

Wine-adjacent retail and services

Market opportunity: Foot traffic centers on tastings, but specialty food, cheese and charcuterie, wine education, and curated Texas-made retail remain thin.

The need/gap: Create reasons to linger between pours. A cheese and wine shop, pairing classes, or a multi-vendor market in the Zesch Building can multiply per-visitor spend.

Outdoor recreation and river outfitting

Market opportunity: Llano River kayaking, guided fishing, birding, and bike-to-vineyard routes fit the visitor profile, yet no full-service outfitter anchors this niche.

The need/gap: Bundle morning adventures with afternoon tastings, add shuttles, gear rentals, and guided trips. Position Mason as wine plus outdoors, not wine only.

Takeaway: These three create a flywheel, more beds lead to more meals and retail, more activities justify longer stays, which stabilizes year-round revenue.

Closing Insight

Mason shows how a small town can buy capacity first, then invite the right kind of growth. The play is not chasing big boxes. It is curating hospitality, food, and outdoor operators who extend dwell time and protect character. The scoreboard is simple, more heads in beds, more receipts downtown, more resilience for a rural tax base.

Source links…

Available here: this linked Google Folder.

Social highlights….

This week’s Sponsor… LEIP - ai powered workspace EDOs

LEIP is an ai powered workspace built for Economic Development Organizations.

Let LEIP take care the busy work and free up REAL team.

Next Town: Yoakum, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Whenever you’re ready, here’s how I can help…

Advisory for EDO Leaders: I help cities apply private-sector discipline to public goals and turn strategy into execution. → Book a free 30-minute strategy call