Boring Wins in | Palestine, Texas

The city is fixing pipes before cutting ribbons. Patient money and small bets are building a real base.

“Do the boring work that compounds.”

Upgrade to Texas Street Trends

Every Monday:

Get a city-level impact brief on one emerging technology trend, with practical insights for local EDOs and entrepreneurs.

Weekly trends build on these briefs, connecting local signals to statewide patterns.

Every first Wednesday of the month:

Receive a statewide deep dive on the technologies reshaping Texas, from AI and compute to energy, logistics, biotech, and more.

First monthly report: Wednesday, November 5, 2025.

Plus: Full access to the Texas Street Trends archive as it grows.

Last week’s EDO Roundup…

PEGATRON picks Georgetown for its first U.S. manufacturing site (Oct 27, 2025)

Big win for Central Texas: ~$85M to retrofit a 168,784-sf facility and add hundreds of jobs. Think spillover for PCB, optics, and test/packaging suppliers.

Port Houston completes its portion of Project 11 dredging (Galveston Bay widened to 700’) (Oct 27, 2025)

Wider channel = safer two-way traffic and room for bigger ships. Good news for exporters, resin shippers, and anyone chasing global logistics reliability.

“Project Theo” lands in Cibolo: $450M automated distribution hub, 425 jobs (Oct 28, 2025)

A Fortune 500 is planting a robot-heavy DC on 126 acres off I-10 with a hefty local incentive package. It’s a speed-to-market play right off a major corridor.

Labatt Food Service to build $42M facility in Jarrell, 150 jobs (Oct 28, 2025)

150,000 sf near I-35 to support growth across the region, aided by layered city/county abatements and a water-line boost. Solid mid-market logistics win.

Texas Energy Fund approves loan for a 1,350-MW gas plant in Ward County (Oct 30, 2025)

More dispatchable capacity on the way to stabilize ERCOT as industrial and data center loads surge. Use this when prospects ask about power risk.

Port Houston tops 3.27M TEUs YTD, pacing for another record year (Oct 30, 2025)

Throughput up ~5% with strong resin and manufactured goods exports. If you recruit trade-heavy firms, update your pitch with these numbers.

Lonestar Business Park breaks ground in Comfort: 230,000 sf for small industrial/office (Oct 31, 2025)

New 30-unit park off FM 289/I-10 with 6k–12k sf bays and BTS options. Perfect for users priced out of Boerne/SA looking for quick occupancy.

Boring Wins in Palestine…

Issue 16

B.L.U.F. Palestine is running a steady, disciplined play. Debt is manageable, revenue is tracking, and the city is using the time it bought with fiscal discipline to rebuild core systems, upgrade downtown, and position a rail-served industrial park. The risk, like most small markets, is execution speed and depth of private follow-through.

The facts to watch the remainder of 2025 and into 2026: downtown’s $10M infrastructure work finishing cleanly, sales tax holding its recent gains, and PEDC’s 333-acre rail site landing a first mover. Walmart’s automated DCs and Wayne-Sanderson’s payroll anchor the base, but higher-wage growth will come from advanced manufacturing and healthcare expansion.

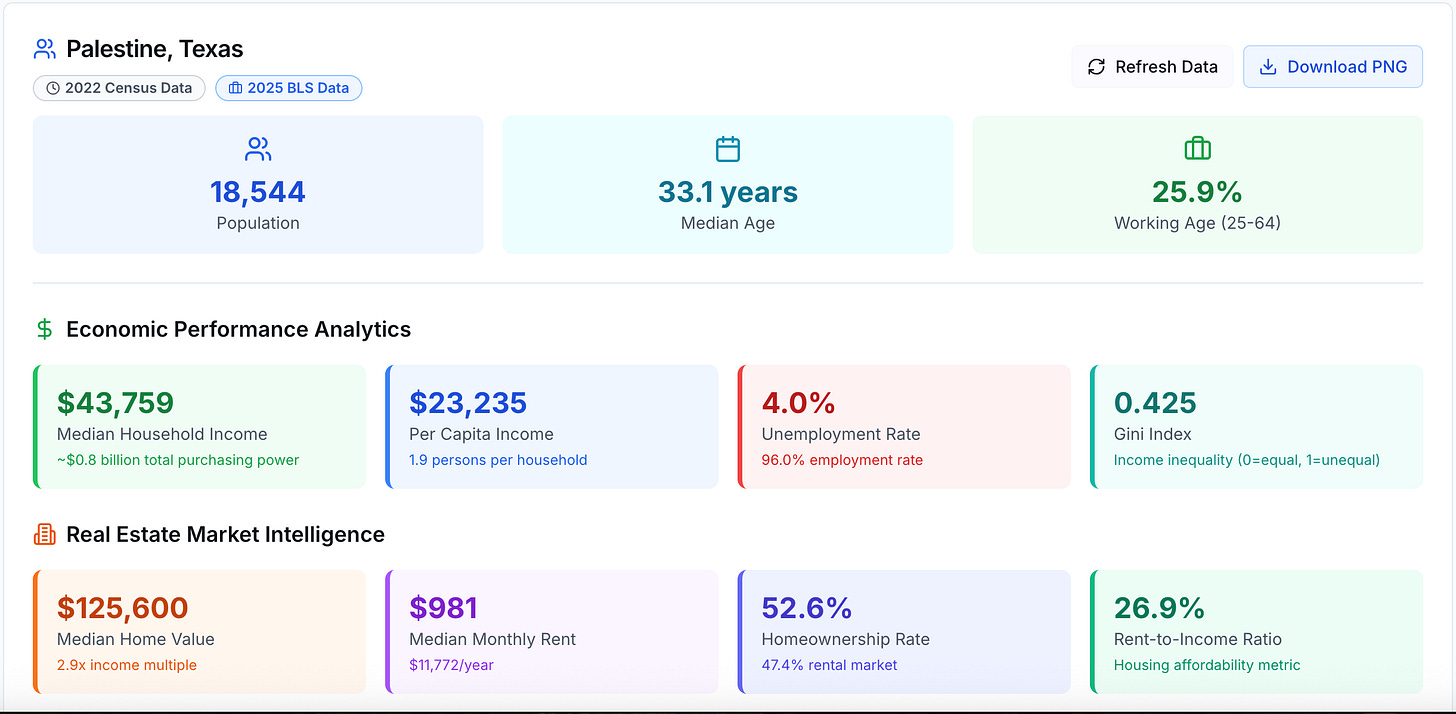

City Financial Profile

Palestine’s FY2025 posture is “stable and investing,” with debt in check and revenues paced by property and sales taxes.

Debt load: Tax-supported principal outstanding was $45.33M at 9/30/2024, S&P rating A+. Major 2022 COs fund: downtown, streets, and water/sewer work.

Tax rate: The adopted FY2025–2026 rate $0.666175 per $100 -

Property tax performance: By March 31, 2025, the city had collected 94.5% of budgeted current levy ($8.66M of $8.99M).

Sales tax trend: January 2025 receipts were +5.01% YoY versus January 2024, with $3.33M FYTD through March.

Permits revenue proxy for activity: General Fund “Permits, Licenses & Fees” hit $267K by March, near full-year budget and +34% YoY, reflecting retail and rehab activity.

Capital focus: City lists a $10M Downtown Infrastructure Improvements program replacing century-old utilities, streets, and drainage.

Takeaway: The city is fiscally steady, with tax-supported debt sized to its base and revenues pacing plan. Council kept FY2025 lean, used debt and grants to tackle deferred infrastructure, and set the stage for private activity to widen the base. The hinge is sales tax resilience and the timing of post-construction downtown leasing.

Economic Drivers

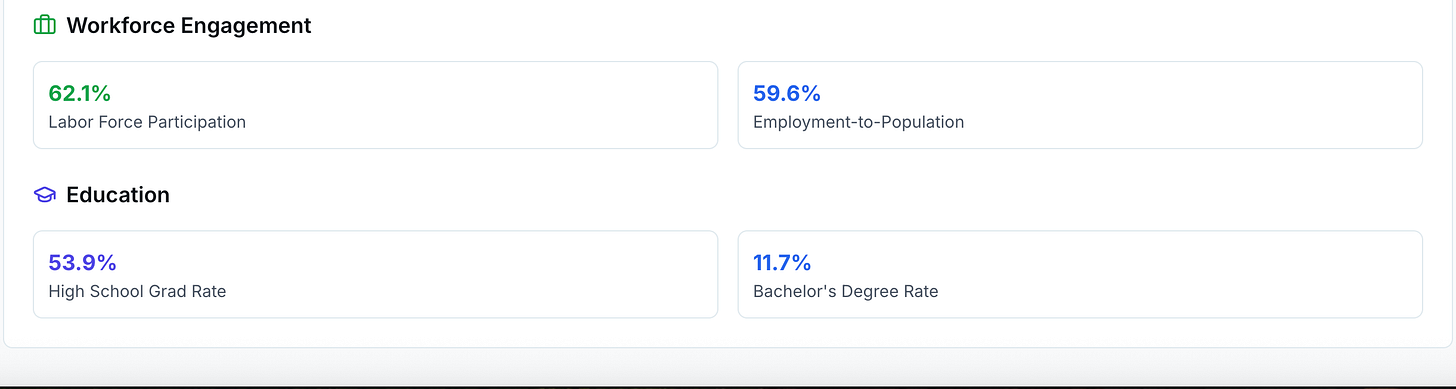

Distribution, food production, healthcare, and government are the anchors, with early signals in advanced manufacturing.

Distribution: Walmart’s RDC #6036 completed a high-tech automation retrofit, with a $21M state filing documenting the 2023–2024 upgrade scope. A second DC (#66005) adds depth.

Food production: Wayne-Sanderson Farms is the largest employer at ~1,130 per PEDC’s major employer list.

Healthcare: Palestine Regional Medical Center reports ~500+ employees, serving a regional catchment beyond city limits.

Emerging/technical: LS Tractor USA and the Columbia Scientific Balloon Facility represent smaller technical footprints that align with PEDC’s targeting.

Tourism/downtown: Texas State Railroad keeps regular traffic to the Palestine Depot, supporting hospitality and retail when paired with events.

Takeaway: The base is resilient but wage-capped. The productivity lift at Walmart and steady PRMC payroll help, yet future wage growth likely depends on advanced manufacturing adds and clinical services expansion, not retail clustering alone.

Business Climate and Growth Indicators

Permitting is active, Loop 256 is the retail spine, and downtown work is enabling private rehab.

Retail corridor: National chains are concentrating along Loop 256 (Aldi, Ross, Marshalls, Ulta, 7 Brew, Smoothie King), with Academy Sports + Outdoors slated in the redeveloped mall area.

Downtown enablement: The $10M infrastructure program replaces water, sewer, storm, streets, and sidewalks in the core, removing key capacity constraints for new tenants.

Industrial land, rail-ready: PEDC acquired 333 acres for a rail-served park next to the Texas State Railroad depot; ~3,000 feet of spur is planned in Phase 1 by end-2025.

Incentives & grants: PEDC Downtown Grants fund up to 75%, capped at $75,000 per address, easing fit-out costs for facade, stabilization, and ADA upgrades.

Takeaway: Barriers are being removed: permits are moving, grants lower up-front costs, and downtown’s hard-infrastructure is getting fixed. Execution risk sits in water/utility timing and in landing a first anchor at the rail park.

Opportunity Gaps

Three near-term, operator-ready plays fit Palestine’s demand and policy posture.

Experiential Retail & Dining, Downtown

Market Opportunity: Post-construction downtown, plus Main Street tourism and Texas State Railroad excursions, create demand for higher-quality concepts. PEDC grants cover up to 75% of eligible costs, $75K max, lowering build-out hurdles.

The Need / Gap: Tenant mix still skews traditional. New utilities, ADA sidewalks, and street work remove the infrastructure excuse. Grants and small-box footprints favor chef-driven restaurants, wine/tasting rooms, and boutique retail.

Select-Service Hotel, Loop 256 Medical District

Market Opportunity: PRMC’s ~500-employee base, visiting clinicians, and vendor traffic, plus business travelers tied to distribution and manufacturing, point to an 80–120-key select-service flag.

The Need / Gap: Current lodging stock under-captures weekday medical and industrial demand. Modern rooms with small meeting space near Loop 256 would improve rate and length of stay.

Rail-Adjacent Cold Storage & Food Logistics Hub

Market Opportunity: Wayne-Sanderson (1,130) and regional producers need cold chain capacity. PEDC’s 333-acre, rail-served park can support rail-truck transload and temperature-controlled warehousing.

The Need / Gap: No dedicated cold storage in-county, forcing costlier routing to Tyler or Corsicana. A first phase 100–200K SF box with rail doors and 3PL ops would anchor the park’s value prop.

Takeaway: Each play compounds existing strengths, is supported by current policy tools, and can be sequenced without over-stretching local capacity. Early wins reduce risk for subsequent tenants.

Closing Insight

The next 12 months should prove whether the rail park lands a first mover and whether downtown’s capital unlocks higher-margin operators. If sales tax keeps pace and one advanced manufacturer sticks, the city’s steady posture turns into compounding growth.

Source links…

Available here: this linked Google Folder.

Social highlights….

This week’s Sponsor… LEIP - ai powered workspace for EDOs

LEIP is an ai powered workspace built for Economic Development Organizations.

Let LEIP take care of the busy work and free up your REAL team.

Next Town: Lubbock, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Research tool for this report: LEIP - ai powered workspace EDOs

Palestine’s AI, Data Center, and Nuclear Opportunity

Palestine sits in the path of two fast-moving forces in Texas: the buildout of AI and data center infrastructure and the state’s push to add firm clean power, including advanced nuclear. Power demand is breaking records. Site selectors are prioritizing speed to market. Secondary markets that can prove power, fiber, and permitting are moving up shortlists.

This trend report converts that macro shift into a local operating plan.

The core move is to publicly package: power, fiber, fast permits,” stand up a reliable data center operations workforce, and deliver a disciplined 250 to 500 kW powered shell or edge lab that can scale as demand shows up. In the background, Palestine should position for nuclear-adjacent supply chain work by starting a quality journey and targeting controls, testing, and fabrication niches that match its industrial base.