Why I'm bullish on a “slow” city: Paris, TX

Proof over hype: steady finances, an $85M expansion, a 120,000 sq ft TxDOT HQ, and 500+ acres ready to build.

“Quiet cities that execute will outrun loud cities that advertise with little to no execution.”

This week’s Sponsor… LEIP - an AI Team for EODs

Every city claims to support Business Retention & Expansion.

But behind the scenes, staff are buried in spreadsheets, reports, and endless data requests: Chasing research, Drafting reports, Planning meetings, Building decks and etc…

LEIP is the first AI Team built for economic development.

It takes on the busy work so your REAL team can spend time where it matters... in the field with businesses.

👉 Free your team from busy work - Join the Waitlist.

Last week’s EDO clips…

San Marcos is getting a big new industrial park (Sept 2025)

Developers broke ground on a $22M, 377,000+ sq ft industrial building along the Innovation Corridor. It’s phase one of a 45-acre park designed for logistics and manufacturing tenants.Weslaco just landed a $25M Sam’s Club (Sept 2025)

The project will bring 200+ jobs to a 22-acre site, with incentives from the city helping seal the deal. Opening is expected by September 2026.SpaceX is adding an $8M expansion in Bastrop (Sept 2025)

They’re building an 80,000 sq ft office and also landed a $17.3M grant from the Texas Semiconductor Innovation Fund to boost chip research.

Midland renewed its MOTRAN funding deal (Sept 2025)

MDC is kicking in $142K to accelerate Permian road projects, including Loop 250 and the Todd Road overpass. Odessa is adding $15M for Loop 338.College Station nixed a 600-MW data center project (Sept 2025)

Despite $22M in potential annual tax/utility revenue, the city council unanimously rejected it over noise, water use, and limited jobs (~50).

Tokyo Electron is investing $30M+ in Austin (Sept 2025)

The semiconductor firm will build a technical training & R&D center and secured $3.08M through the Texas Semiconductor Innovation Fund.Fort Worth apparel plant secures Enterprise Zone status (Sept 2025)

A global clothing company is modernizing its site with a $35.35M upgrade, retaining over 200 full-time jobs.

Why I’m bullish on a “slow” city…

Issue: 09

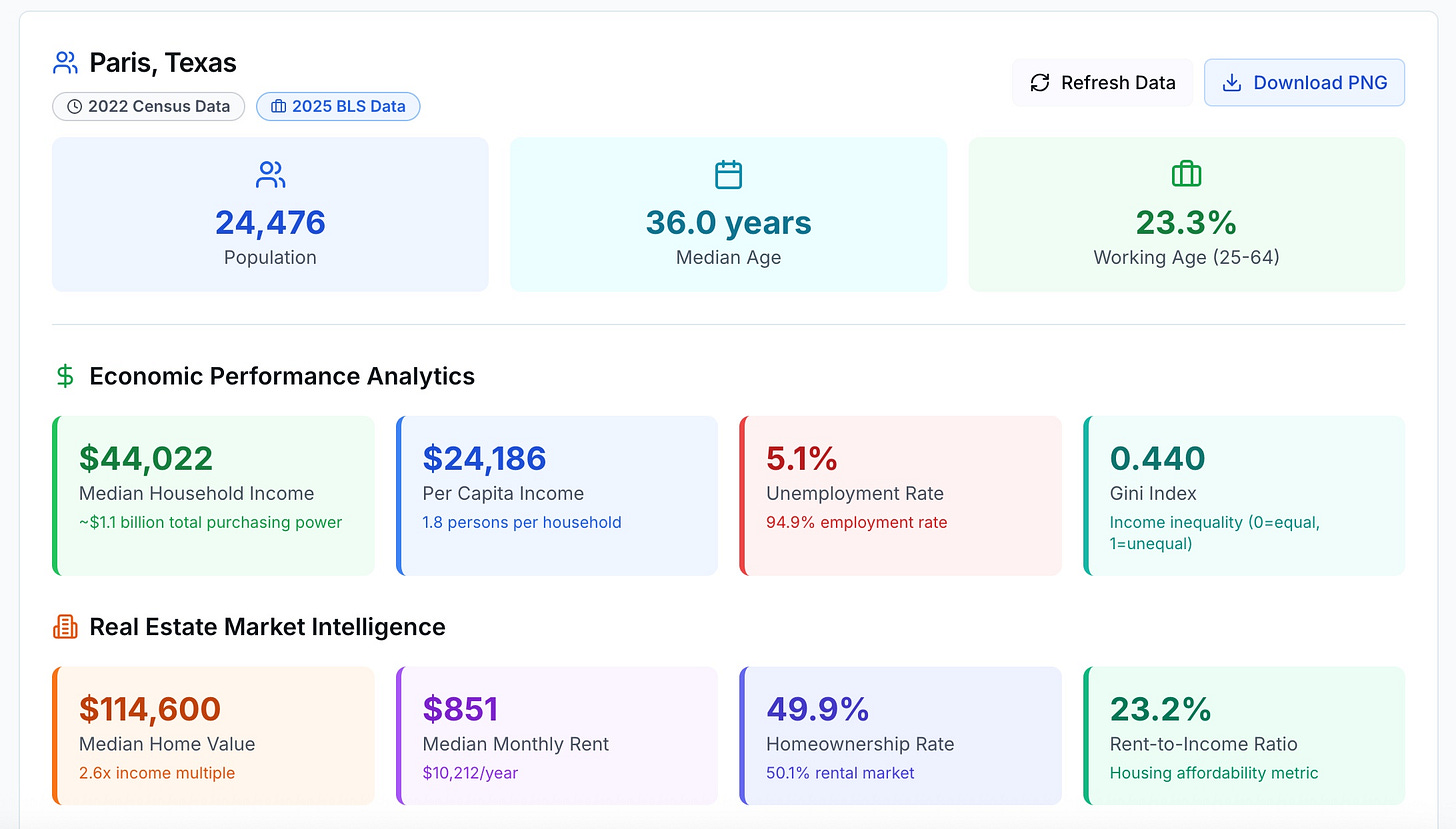

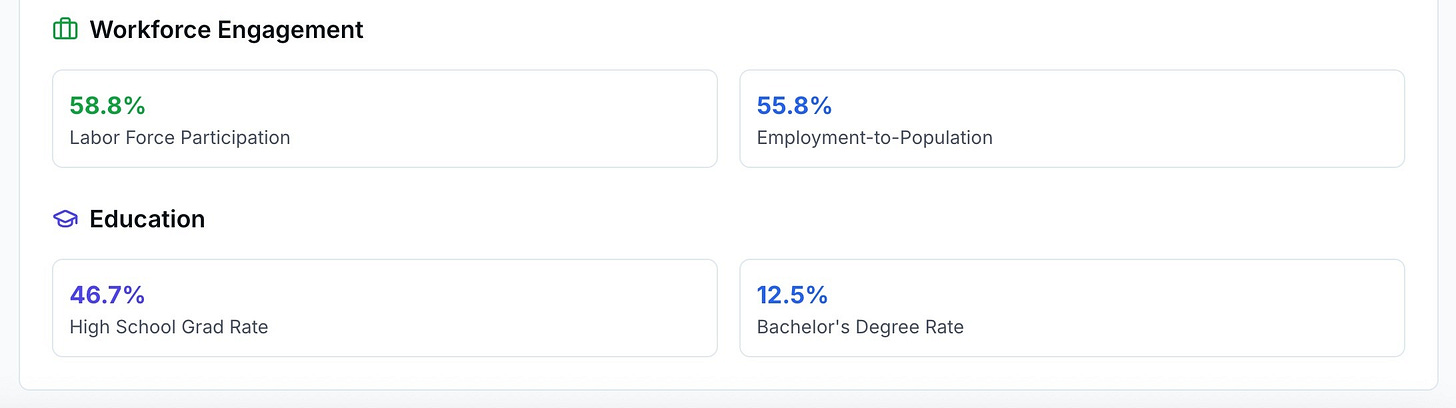

B.L.U.F.: Paris, Texas is a stable regional hub with clear momentum in advanced packaging, food manufacturing, and public-sector infrastructure. Confirmed 2023–2025 actions include an $85M Huhtamaki expansion adding ~80 jobs by ramp-up, Campbell Soup’s conversion of the 60-year Paris plant into its flagship sauce facility over about two years, and TxDOT’s new 120,000-sq-ft Paris District headquarters that retains ~160 jobs and ~$10M in annual payroll.

Municipal finances appear disciplined, with an active TIRZ (tax increment reinvestment zone) No. 1 and recent federal support for industrial park infrastructure, while the labor market is tight at ~4.0% unemployment as of July 2025 in Lamar County. These conditions, plus 500+ acres of marketed industrial sites, put Paris in position to compete for logistics and supplier growth tied to its manufacturing base.

Paris functions as the service and employment center for Northeast Texas and Southeast Oklahoma along the US-82 corridor.

City Financial Profile

Paris maintains conservative budgeting and targeted use of special districts while leveraging outside funding for industrial infrastructure.

Adopted property tax rate for FY2024–25: $0.46120 per $100 valuation

Allocated to General Fund (Operations and Maintenance): $0.31292

Allocated to Interest & Sinking Fund (Debt Service): $0.14828

Estimated General Fund levy: ~$8.53 million

Estimated Interest & Sinking levy: ~$3.81 million

Property tax adoption details: staff memo and ordinance materials prepared for the Sept. 9, 2024 meeting set the rate and expected levy by fund.

Debt support: the I&S portion of the levy is budgeted at ~$3.812M for debt service payments in FY2025.

TIRZ: Paris Tax Increment Reinvestment Zone No. 1 reported $97,420.92 in 2022-23 increment distribution.

Takeaway: The city’s adopted rate and I&S levy provide a clear, sustainable structure for servicing debt, while steady local labor conditions reduce near-term fiscal stress.

Economic Drivers

Manufacturing and healthcare anchor Paris, with packaging, food processing, and regional services leading near-term growth.

Regional medical hub: Paris Regional Health reports a staff of 900+ and 154 beds, serving Northeast Texas and Southeast Oklahoma.

Major employers: Paris EDC lists Paris Regional Health (~900), Kimberly-Clark (~700), and Campbell Soup (~680) among top employers, with American SpiralWeld Pipe and Huhtamaki also in the base.

Huhtamaki expansion: Company and EDC materials confirm an expansion in Paris, with the EDC documenting a total project value of ~$85M and ~80 new jobs; Huhtamaki corporate notes ~$30M in production assets with ramp-up starting in Q1 2025.

Campbell Soup transformation: Campbell is converting the Paris plant into its flagship sauce facility, ending soup production and affecting ~300 of ~680 roles over about two years, aligned with a broader ~$230M supply-chain optimization across the network.

TxDOT district HQ retention: The new 120,000-sq-ft headquarters retains ~160 jobs and ~$10M annual payroll in Paris.

Labor market context: Lamar County’s unemployment rate was 4.0% in July 2025, about even with Texas (4.0%) and below the US (4.2%)

Takeaway: Healthcare scale, packaging capacity growth, and the Campbell shift deepen Paris’s role in food and consumer-goods supply chains while the TxDOT campus secures a government services anchor.

Business Climate and Growth Indicators

Permitting, land availability, and recent certifications indicate a pro-investment stance.

Zoning and development: The Planning & Zoning office maintains the zoning ordinance and official map; historical ordinance shows multiple district classifications and a Board of Adjustment framework.

Industrial land: The PEDC markets a 116-acre shovel-ready site at Gene Stallings Business Park, with additional sites at Northwest and Southwest parks that sum to well over 500 acres of marketed industrial land across the city.

Infrastructure funding: EDA’s $1.3M grant targets water and roadway upgrades at Northwest Industrial Park, supporting expansion and recruitment.

Film/digital media readiness: Paris earned “Film Friendly Texas” certification in April 2025 and the “Digital Media Friendly Texas” designation in July 2025, signaling streamlined production support.

Takeaway: Clear land inventory, infrastructure upgrades, and business-friendly certifications improve Paris’s “speed-to-greenlight,” although tight labor means projects should plan for pipelines and training.

Opportunity Gaps

Three focused plays align with Paris’s anchors and verified market signals:

Healthcare Support Services

Market opportunity: Expand outpatient diagnostics, rehab, and senior services tied to a 900+ employee regional hospital.

Need/gap: Reduce out-of-market leakage for specialty care and post-acute services.

Food & Packaging-Adjacent Logistics

Market opportunity: Recruit regional distribution and value-added logistics supporting Campbell’s sauce hub and Huhtamaki’s folding-carton ramp-up.

Need/gap: Modern cross-dock and temperature-managed space on Loop 286 with rail adjacency where feasible.

Mixed-Use & Infill Commercial near Growth Nodes

Market opportunity: Capture service and retail demand from Forestbrook Estates build-out and downtown visitation, leveraging TIRZ capacity.

Need/gap: Coordinated site assembly, façade and code upgrades, and small-tenant TI financing.

Takeaway: These bets compound off anchors already in motion, with TIRZ proceeds and EDC tools suited to de-risk early phases.

Closing Summary

Paris is operating from a position of fiscal stability while leaning into core strengths in healthcare, packaging, and food manufacturing. Confirmed moves like Huhtamaki’s expansion, Campbell’s facility transition, and the new TxDOT district headquarters reinforce its role as a regional hub. With ready sites, targeted infrastructure funding, and a tight but resilient labor market, the city is set up for steady, measured growth built on what already works.

Source links…

Available here: this linked Google Folder.

Over time, I’ll also drop in other context interview notes, photos from site visits, etc. If there’s anything else you’d find useful in that folder, let me know in the comments.

Social highlights…

Next Town: Giddings, Texas

Have a great week! See you next Monday.

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.