The Micropolitan Upgrade Happening in Stephenville, Texas

Tarleton demand plus industrial depth is pushing the city from maintenance to expansion, fast. A voter-approval tax rate, falling debt service, and a capital pipeline that tells you what’s coming next

If it’s easy, it’s priced in.

If it’s boring, it matters.

If it’s local, it decides.

That’s the lens for this week.

Omegadson

Upgrade to Texas Street All Access | $50/month| All-Access gives you statewide intelligence and a network of operators who are in the trenches with you.| Subscribe Now

Last week’s EDO Roundup…

Global manufacturer picks Houston area for first US plant (Dec 30, 2025): VT Chemical (Uzbekistan-based) is planting its flag in Hitchcock with a 35,000 sq ft facility on 5 acres, planning $7M+ in investment and 27 jobs. Local incentives include abatements and grants, plus a Texas Enterprise Zone designation, and the site will also serve as a U.S. distribution hub.

SMU ends cleaning contract, triggering layoffs for 211 workers (Dec 30, 2025): SMU is switching janitorial vendors, and ABM Texas General Services filed notice that 211 workers will be laid off effective March 12, 2026. ABM says it plans to offer other roles where possible, but it’s still a real workforce hit in Dallas.

Sensei Ag coming to Lockhart (Dec 31, 2025): Lockhart just landed Sensei Ag with a county-approved Chapter 381 incentive agreement. The story frames it as up to $51M in investment and dozens of jobs, tied to warehouse and greenhouse facilities.

Lamar State College Port Arthur partners with shipyard for new apprenticeships (Dec 31, 2025): This one’s a solid workforce win. Lamar State College Port Arthur and Gulf Copper launched a shipfitting apprenticeship paying $15/hour, with 20 apprentices per cohort, starting Jan. 26, 2026, and tuition covered through the U.S. DOL registered apprenticeship funding.

Traffic alert: TxDOT to close intersection of I-10, La Cantera Parkway (Jan 2, 2026): Heads up for anyone tied to the San Antonio growth machine. TxDOT is pushing closures tied to the $1.4B Loop 1604 North Expansion, widening from 4 to 10 lanes and running through 2028, including a big $463M interchange rebuild at I-10.

Texas creates advanced nuclear office, names director, invests $350 million (Jan 2, 2026): Texas created the Texas Advanced Nuclear Energy Office and backed it with a $350M development fund, naming Jarred Shaffer as director. The piece also notes $120M allocated to Texas Tech, ACU, and Natura Resources tied to molten salt reactor work, which is Texas basically saying “we’re serious about advanced nuclear.”

The Micropolitan Upgrade Happening in Stephenville

Issue 24

B.L.U.F. Stephenville is running a classic “micropolitan upgrade” play, using Tarleton State’s growth plus a deep manufacturing base to justify bigger infrastructure and higher service expectations. The city leaned into that reality in FY2025–2026 by adopting the voter-approval tax rate and capturing more of the appraisal and new construction upside.

At the same time, the numbers show a city trying to scale without letting debt service swell, while the market scrambles to deliver housing that fits faculty, plant managers, and young families, not just students.

City Financial Profile

Stephenville’s FY2025–2026 posture is expansion-focused, with higher property tax collections, a defined capital planning framework, and a debt mix split between tax-supported and revenue-supported obligations.

Adopted property tax rate: $0.4000 per $100 for FY2025–2026, set at the voter-approval tax rate.

Tax rate composition: M&O rose to $0.3868, while the debt rate fell to $0.0132 (down from $0.0149).

Property tax revenue lift: The budget states property tax revenue increases by $573,214 (+7.22%), with $147,458 from new property added to the roll.

Household impact example (city portion): Average residence homestead value listed at $244,903, with a city tax example of $979.61 and an 8.87% increase.

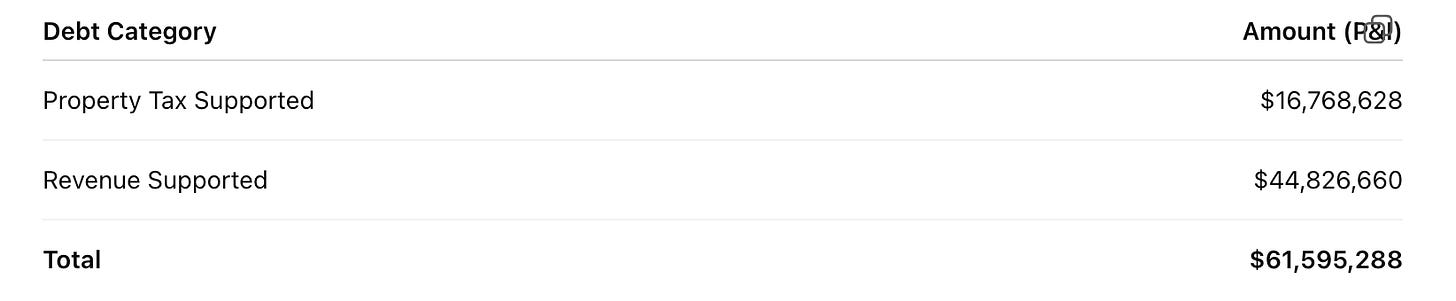

Debt obligations (principal and interest): $61,595,288 total, split between $16,768,628 property-tax-supported and $44,826,660 revenue-supported.

Tax Rate and Levy Mechanics

Debt Obligations (P&I)

Takeaway: Stephenville is clearly choosing to capture growth-driven revenue now, while keeping the debt rate moving down. The tell to watch is execution, can the city keep capital delivery predictable so tax increases translate into visible capacity and service improvements.

Economic Drivers

Stephenville’s economy works because it is not one thing. Higher education anchors demand, manufacturing adds wage depth, and dairy keeps the regional supply chain real.

Tarleton scale: Tarleton hit a record fall 2024 enrollment of 18,033, which lifts housing demand and year-round retail traffic.

Largest local employer: Tarleton listed at 1,100 FTE, plus 500+ part-time student workers per the Chamber profile. Manufacturing depth: Multiple major plants show up with meaningful headcounts, including TechnipFMC (735) and Saint-Gobain (470).

Dairy is still a major pillar: The Chamber profile states Erath County ranks #3 in milk production in Texas. Stephenville Chamber Community Profile.

National logistics signal: Amazon operates a 215,000 sq ft delivery station in Stephenville, and public listings show 51–200 employees.

Major Area Employers

Takeaway: The “college town” label undersells Stephenville. The real advantage is the combination of stable education demand and an industrial base that can carry taxable value, wages, and supplier networks through cycles.

Business Climate and Growth Indicators

Stephenville is tightening its development posture, pairing planning work with visible project flow and brand-level retail validation.

Comprehensive plan adopted: Stephenville adopted the Stephenville 2050 Comprehensive Plan on August 20, 2024 (City Council).

Planning commission context: May 2024 planning minutes reference the comprehensive plan work and student housing pipeline discussion.

Convocation Center demand pull: SEDA minutes note the Tarleton State Convocation Center is scheduled to be operational by 2025, and is driving retail and hospitality interest.

Named projects in motion: SEDA minutes cite active projects including Interstate Inn, Amazon, and Cavender’s.

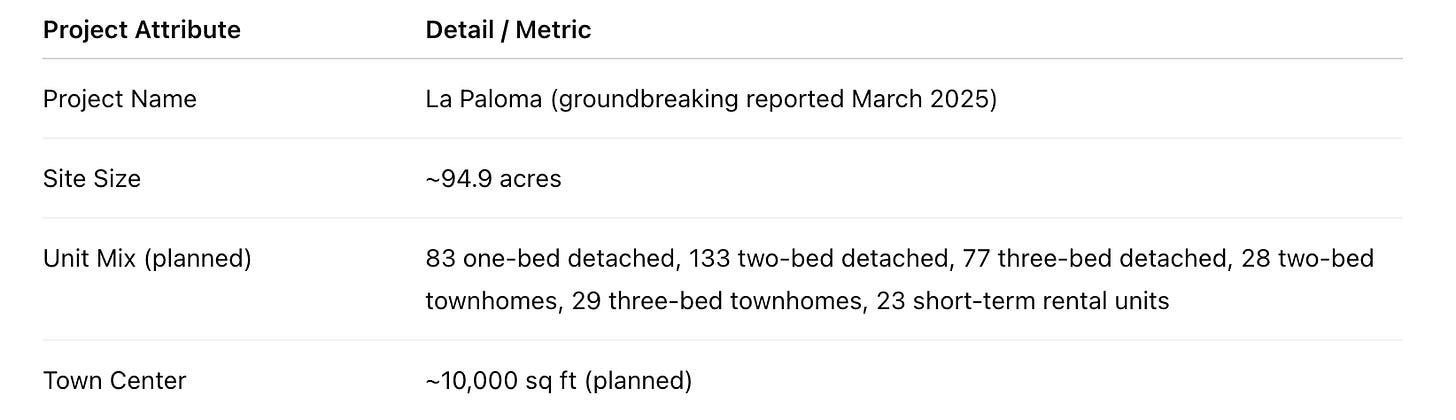

La Paloma Built-to-Rent Signal

Takeaway: The story is not just “more rooftops.” It is the city trying to shape the mix, with planning plus projects that signal a move toward higher-quality housing and a more regional retail profile.

Opportunity Gaps

Stephenville has momentum, but the next chapter depends on removing three predictable friction points.

Housing Mix That Protects Workforce Supply

Market Opportunity: Support purpose-built student housing and professional-grade rentals in the right places.

Need / Gap: Planning discussions show student housing demand pressure, which can spill into single-family neighborhoods if supply does not keep up.

Utility and Street Capacity That Keeps Deals “Yes-able”

Market Opportunity: Build a public-facing, fundable capital pipeline tied to the five-year CIP framework.

Need / Gap: Debt obligations are large in total ($61.6M P&I) and growth will keep pulling on utilities, streets, and drainage.

After-Hours Amenities That Match the New Demand Floor

Market Opportunity: Recruit and enable a small set of “sticky” evening anchors, dining, entertainment, and boutique hospitality.

Need / Gap: SEDA notes growing brand activity and event-driven demand (Convocation Center), but the market still needs more places that keep residents and visitors local after 5 p.m.

Takeaway: These three gaps are tied together. If housing, capacity, and after-hours demand move in sync, Stephenville becomes harder to outcompete and easier to invest in.

Closing Insight

Stephenville is showing what “smart micropolitan growth” looks like when the city is willing to price services honestly, while still keeping debt service disciplined. The opportunity now is execution discipline, turning plans and debt capacity into visible, on-time projects that remove friction for employers and developers. If the city keeps the housing mix broad and the capital pipeline predictable, the next wave of growth will feel intentional instead of accidental.

Next Town: Cuero, Texas

Have a great week! See you next Monday. Happy New Years!

Grateful,

Omegadson

P.S. Don’t forget to connect with and follow Texas Street on LinkedIn and Facebook.

Whenever you’re ready, EDO leaders…

Strategy Session w/ me; focused 30-minute meeting designed to quickly align on goals and priorities. You can expect crisp insights, well-defined next steps, and an actionable plan to move your strategy forward in a concise, decision-driven format.